Paying for Group Health Plan Administrative Expenses

Here's a question from an employer about paying the administrative expenses of a group health plan. Q. Due to declining health care spending during the COVID-19 pandemic, we anticipate receiving a medical loss ratio rebate Read More

Sep 15, 2020

Hobby or Business? How to Treat COVID-19 Sideline Activities for Taxes

Today, many people sell homemade products online or work on some unincorporated sideline venture outside of their regular day jobs. Such activities can generate extra spending money. This can be especially helpful for retired people Read More

Sep 15, 2020

Kirsch CPA Group Named Best of the Best

INSIDE Public Accounting (IPA) has unveiled its list of the Best of the Best public accounting firms in the nation for 2020 and... Kirsch CPA Group is a Best of the Best, again! Kirsch CPA Read More

Sep 03, 2020

Meet our Newly Promoted Senior Analysts

We are proud to announce the promotion of Ryan Smith and Alex Getz to Senior Analyst. "Both Ryan and Alex have provided our clients with exceptional value. We are excited to promote these two individuals Read More

Sep 03, 2020

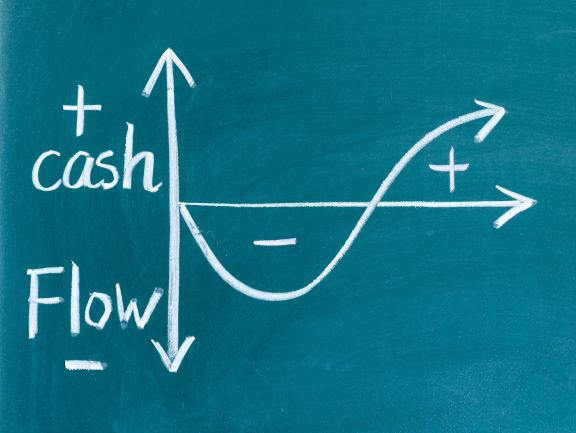

Forecasting Cash Flow for Valuation in COVID-19 Era

Business valuation is a prophecy of the future. That is, investors typically value a business based on its ability to generate future cash flow. The COVID-19 crisis has caused operations to change for many businesses, Read More

Sep 03, 2020

The IRS Releases this Year’s Dirty Dozen Tax Scams

Each year, the IRS compiles a list of 12 common tax scams that taxpayers may encounter during the year. This year, the "dirty dozen" list focuses on scams that target individual taxpayers, with special emphasis Read More

Aug 24, 2020

Monitor These 3 Things as COVID-19 Changes Your Nonprofit’s Priorities

Several months into the COVID-19 crisis, most not-for-profit organizations have formulated at least a temporary plan for sustaining operations. But short-term solutions should be complemented by long-term strategic planning that reprioritizes objectives. Specifically, your nonprofit Read More

Aug 11, 2020

Purchasing a Business Vehicle – What Is Deductible for 2020?

Purchases of a new and used business vehicle may qualify for tax breaks under current tax law. If you need a new vehicle to use for business purposes, review these details before you go shopping. Read More

Aug 11, 2020

5 Mid-Year Tax Planning Tips for Business Owners

The second half of 2020 has begun and it is more important than ever to consider mid-year tax planning ideas. What steps can business owners take today to lower taxes for the current tax year? Read More

Aug 06, 2020

PPP Loan Forgiveness Update

We understand that many PPP borrowers are anxious to get started with the loan forgiveness process for a variety of reasons. Our Covid-19 team has kept completely updated on all guidance issued and stands ready Read More

Jul 29, 2020