8 Ways to Insulate Your Construction Company Against Rising Costs

The construction industry continues to face supply chain slowdowns, labor shortages and inflation — though the latter of the three has generally moderated a bit as of late. To monitor and optimally respond to rising Read More

Feb 10, 2023

The Case for a Digital Construction Enterprise

The construction industry has always been all about mobility. Yet many contractors continue to hold on to paper processes that keep employees — and project information — unnecessarily tethered to the front office. The widespread Read More

Jan 18, 2023

Succession Planning Considerations for Construction Business Owners

Construction company owners are great at completing projects, but many struggle to properly build a succession plan. Even if your retirement is decades away, it's never too early to start. In fact, by initiating the Read More

Dec 14, 2022

Prevent Fraud at Your Construction Company With a Holistic Approach

Most experts would agree that the best way to minimize fraud at any company, including a construction business, is to take a holistic approach. As the owner, you must set the tone at the top Read More

Nov 30, 2022

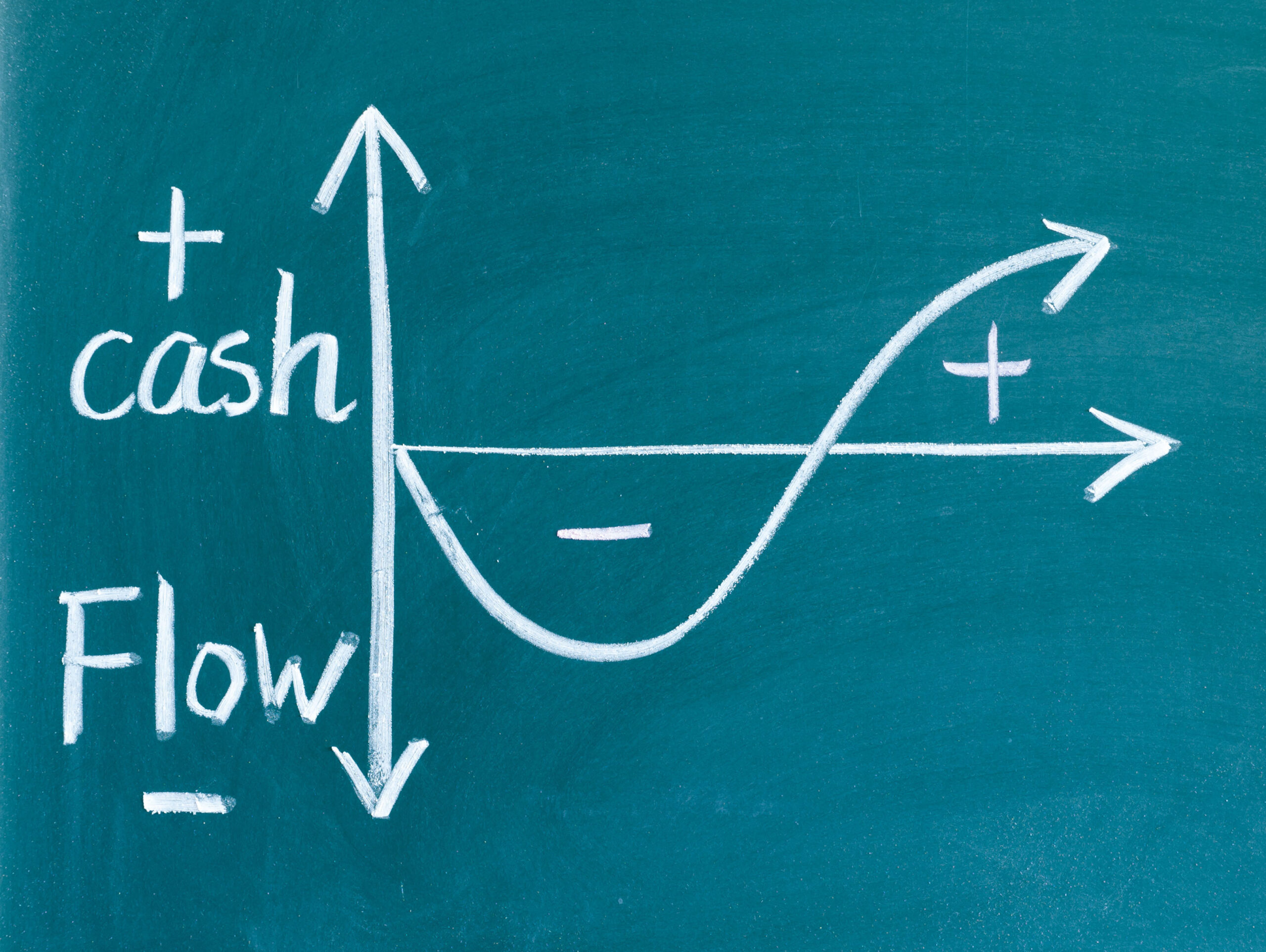

9 Cash-Flow Management Tips for Construction Companies

Construction business owners know that cash is king. However, managing cash flow in an industry known for its ebbs and flows isn't easy. And when you throw in the steady rise of inflation and ongoing Read More

Oct 13, 2022

Manage Your Construction Business … and Your Wealth

Many contractors prioritize business financial management over personal wealth management. It's an easy trap to fall into given how competitive the construction industry can be. Let's discuss some ways to manage your wealth while you Read More

Sep 14, 2022

5 Common Billing Methods in the Construction Industry

Your neighborhood ice cream shoppe no doubt operates under a simple fixed price, point-of-sale billing method. Construction companies don't have it so easy. Because of the project-based, decentralized nature of construction work, contractors need to Read More

Aug 18, 2022

Reviewing Revenue Recognition for Construction Companies

While many businesses handle sales in a single transaction, construction contracts often cover months or even years and include multiple payments. As you're well aware, the longer-term nature of construction projects can prevent contractors from Read More

Jul 20, 2022

Could the Work Opportunity Tax Credit Help Your Construction Company?

The construction industry has been facing a labor shortage for years. Although there are various ways to tackle the challenge, one approach to keep in mind is expanding your hiring pool to, in part, avail Read More

Jun 23, 2022

3 Ways Your CPA Firm Can Facilitate Your Strategic Growth Planning

While there is a perception that accounting firms spend all their time looking in the rearview mirror to prepare taxes and financial statements, the right accounting firm can help you see where you’re going with Read More

May 25, 2022