Are Your Construction Contracts COVID-proof?

It's the fourth quarter of 2020, and the COVID-19 pandemic continues to affect the construction industry. Project delays, work stoppages, supply chain disruption and lost productivity remains a reality for many contractors. All of this Read More

Oct 15, 2020

Tax Implications When Lenders Cancel Debts in the COVID-19 Era

In the COVID-19-ravaged economy, debts can pile up beyond a borrower's ability to repay. Lenders sometimes may be willing to forgive (or cancel) debts that are owed by certain borrowers. While debt forgiveness can help Read More

Oct 01, 2020

Hobby or Business? How to Treat COVID-19 Sideline Activities for Taxes

Today, many people sell homemade products online or work on some unincorporated sideline venture outside of their regular day jobs. Such activities can generate extra spending money. This can be especially helpful for retired people Read More

Sep 15, 2020

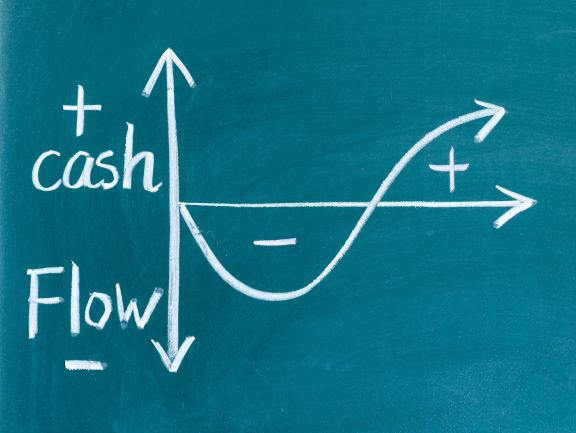

Forecasting Cash Flow for Valuation in COVID-19 Era

Business valuation is a prophecy of the future. That is, investors typically value a business based on its ability to generate future cash flow. The COVID-19 crisis has caused operations to change for many businesses, Read More

Sep 03, 2020

Tax Considerations for Principal Residence Foreclosures Today

Despite the COVID-19 crisis, residential real estate prices generally remain stable or are even rising in many areas. Even so, pandemic-related financial stress may cause some homeowners to be unable to make their mortgage payments. Read More

Aug 19, 2020

Monitor These 3 Things as COVID-19 Changes Your Nonprofit’s Priorities

Several months into the COVID-19 crisis, most not-for-profit organizations have formulated at least a temporary plan for sustaining operations. But short-term solutions should be complemented by long-term strategic planning that reprioritizes objectives. Specifically, your nonprofit Read More

Aug 11, 2020

FASB Offers Reprieve from Updated Lease and Revenue Recognition Rules

If you're feeling burned out from coping with extreme circumstances brought on by the COVID-19 pandemic, you're not alone. Fortunately, the Financial Accounting Standards Board (FASB) and Congress are offering some compliance-related relief for certain Read More

Jul 23, 2020

COVID-19 Crisis May Affect Tax Angles for Rental Property Losses

The economic fallout from the COVID-19 crisis will cause many rental real estate properties to run up tax losses in 2020 — and possibly beyond. Here's a summary of important federal income tax rules for Read More

Jul 10, 2020

HIPAA Special Enrollment during COVID-19 Emergency

Here's a HIPAA-related question from one employer. Q. How long are the extended HIPAA special enrollment periods during the COVID-19 emergency? A. In response to the COVID-19 emergency, the Department of Labor and IRS issued Read More

Jul 10, 2020

Tax Relief Federal Tax Deadline

As a COVID-19 relief measure, the IRS has postponed many of the usual federal tax filing and payment deadlines, along with the deadlines for taking certain other tax-related actions. Generally, deadlines for federal income tax Read More

Jul 10, 2020