Work in process (WIP) is a common term in manufacturing, often tossed around loosely. WIP is sometimes used interchangeably with “work in progress.”...

The IRS Issues Final Regs for the Advanced Manufacturing Production Credit

Dec 03, 2024The IRS has published final regulations for the Section 45X advanced manufacturing production credit. The final regs update several significant areas from the p...

Refresher on First-Year Section 179 Depreciation Deductions

Nov 20, 2024Internal Revenue Code Section 179 potentially allows significant first-year depreciation deductions when your business places qualifying assets into service. Yo...

How To Handle the Changes to R&E Tax Treatment

Nov 05, 2024The Tax Cuts and Jobs Act (TCJA) included a significant — but delayed — change to the tax treatment of research and experimentation (R&E) expenses under...

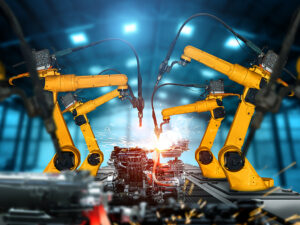

Manufacturers: How Vulnerable Are You to Fraud?

Oct 25, 2024Fraud is a significant problem for all businesses, but the manufacturing industry is particularly vulnerable. According to the Association of Certified Fraud Ex...

Manufacturers: Implement Year-End Tax Planning Strategies Now to Reduce Your 2024 Tax Bill

Oct 14, 2024As the year draws to a close, it’s generally manufacturers’ last chance to implement strategies to reduce their 2024 tax liability. Several provisio...

How To Choose the Best Inventory Accounting Method for Your Manufacturing Company

Aug 26, 2024Your choice of accounting method for determining the value of your manufacturing company’s inventory can significantly impact your overall tax bill. Here ...

Manufacturers Should Consider These 7 Midyear Tax-Reduction Moves Now

Jul 17, 2024July marks the halfway point of the year and is generally an ideal time for manufacturers to assess their tax situation and plan appropriate strategies for redu...

Can Your Manufacturing Company Benefit from a Cost Segregation Study?

Jun 12, 2024When manufacturers buy, build or improve their facilities, it involves a substantial investment. But these expenses generally can’t be immediately deducte...

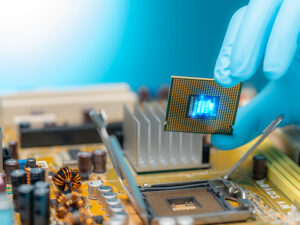

IRS Issues Final Regulations Regarding the Advanced Manufacturing Investment Credit

May 10, 2024The Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Act — signed into law in 2022 — provides generous tax incentives to increase d...