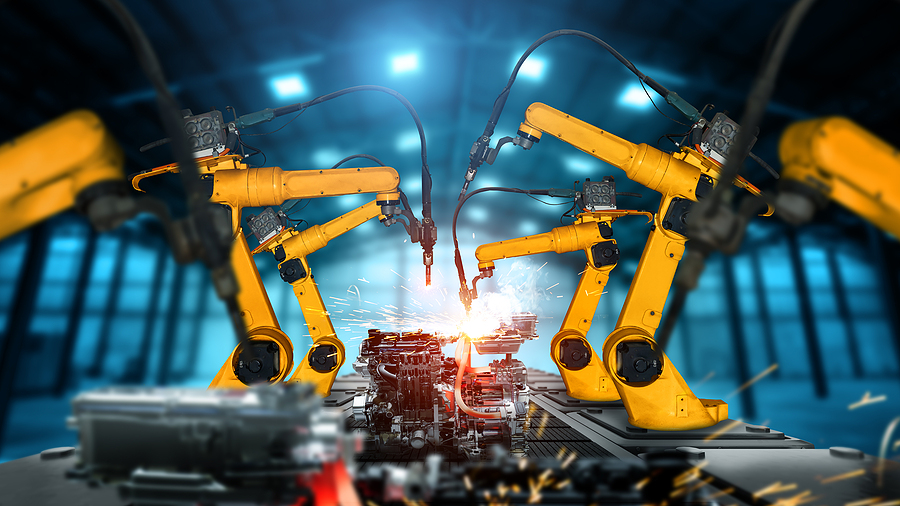

Are You Prepared to Join the Manufacturing 4.0 Revolution?

Manufacturing 4.0, sometimes called "Industry 4.0," refers to the digitalization of manufacturing. That means the integration of traditional manufacturing processes and practices with cutting-edge "smart" technology. How might Manufacturing 4.0 benefit your manufacturing company? According Read More

Oct 10, 2023

Successfully Navigating the Shift to Reshoring Manufacturing Production Can Be Tricky

For decades, products that were made in America were synonymous with high quality and were manufactured in great abundance. Comparable products from other countries were often viewed as cheaper knockoffs. However, in the late 20th Read More

Aug 13, 2023

Manufacturers: If Available, Take Advantage of Sales Tax Exemptions

Manufacturers must comply with all relevant tax laws to avoid dire consequences. While the most attention is generally directed toward federal income and payroll taxes, there's another potential aspect to consider: state sales tax. The Read More

Jun 14, 2023

Is Your Manufacturing Company Eligible for Clean Energy Tax Credits?

The Inflation Reduction Act (IRA), enacted in late 2022, provides valuable tax credits that support clean energy manufacturing. Significantly, the law created the Advanced Manufacturing Project Tax Credit (45X MPTC), which is an incentive for Read More

May 09, 2023

Need a CFO? Hire or Outsource

Small business owners often have accounting questions and financial advisory needs that don’t always occur at regular intervals or around tax time. Opportunities to grow your business crop up with a little warning. How does Read More

Apr 28, 2023

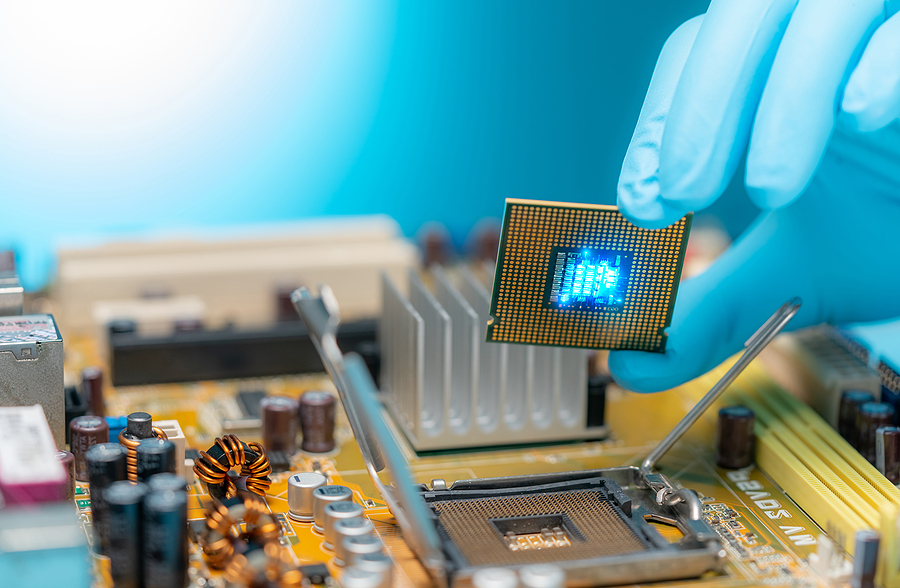

IRS Issues Guidance for Manufacturers on New Semiconductor Tax Credit

The IRS has released proposed regulations that provide guidance for manufacturers on the implementation of the Advanced Manufacturing Investment Credit. The credit, created by the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act, encourages manufacturers Read More

Apr 12, 2023

Do You Know How SECURE 2.0 Will Affect Your Manufacturing Company?

The SECURE 2.0 Act, enacted at the end of 2022, expands on the retirement plan improvements made by the Setting Every Community Up for Retirement Enhancement Act of 2019 (the SECURE Act). In general, SECURE Read More

Mar 16, 2023

Is Your Financial Reporting on Target?

While your P&L paints a broad picture of financial viability, it may not be telling you the whole story. Too often, businesses have a financial reporting structure that makes it difficult to identify what’s driving Read More

Mar 10, 2023

7 Tax-Saving Opportunities for Manufacturers in 2023

After your manufacturing company's 2022 tax return has been filed, you can focus your efforts on reducing its 2023 tax liability. What are the top tax-saving opportunities available to manufacturers this year? Here are seven Read More

Mar 02, 2023

LIFO vs. FIFO: Taking Stock of Your Inventory Accounting Method

How inventory is accounted for can have a significant impact on your tax bill if your business involves the production, purchase or sale of products. In some cases — particularly during periods of high inflation Read More

Feb 10, 2023