CARES Act Tax Provisions

On Friday, March 27, 2020, the Coronavirus Aid, Relief and Economic Security (CARES) Act was signed into law. The Act includes numerous provisions that provide tax relief as a result of the Coronavirus epidemic. The Read More

Mar 30, 2020

Tax Filing Deadline Remains April 15 – Payment Due Extended to July 15

3/20/2020 - UPDATE - Filing Deadline Moved to 7/15/2020 The IRS just announced that the tax FILING deadline is being moved to 7/15/2020 along with the previously announced tax payment deadline. 3/19/2020 - Tax Filing Read More

Mar 19, 2020

Has the TCJA Lowered Your Taxes?

We now have two years of the Tax Cuts and Jobs Act (TCJA) changes under our belts: 2018 and 2019. Has the TCJA Lowered Your Taxes? Not surprisingly, the answer depends on your specific situation. Read More

Mar 06, 2020

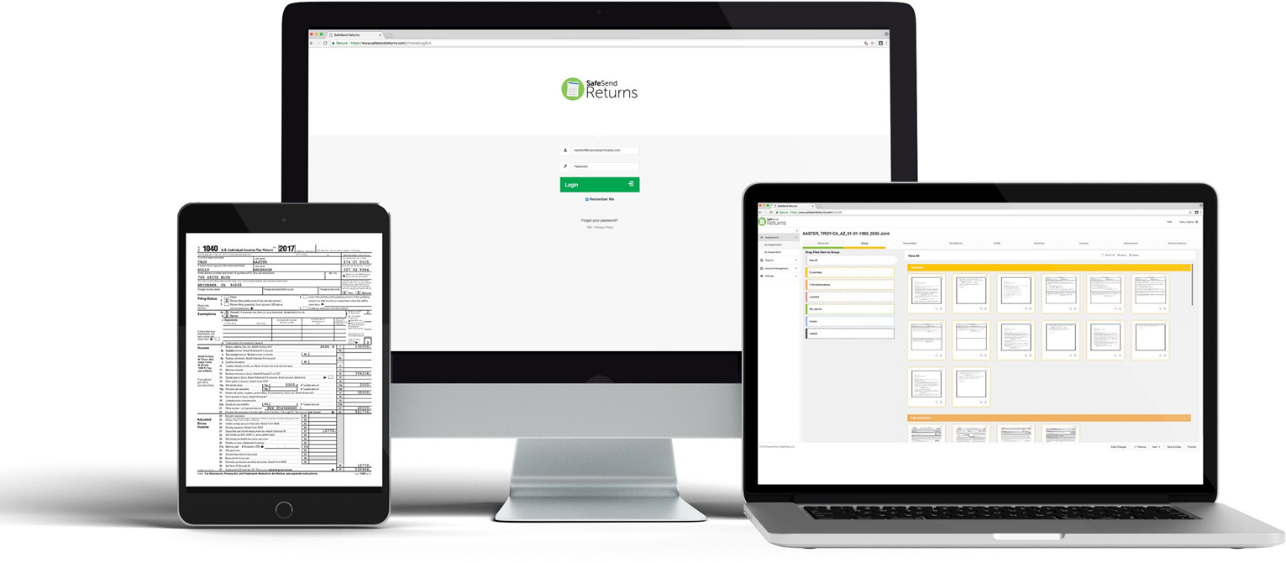

Introducing SafeSend Returns for Secure Delivery

UTILIZING TECHNOLOGY SOLUTIONS TO BETTER SERVE YOUR NEEDS Kirsch CPA Group is introducing SafeSend Returns™, an electronic system that automates the Delivery of Tax Returns to our clients. SafeSend Returns offers our clients an easier to Read More

Jan 13, 2020

Put the Tax Cuts to work for your Business

Do you know the highest individual tax rate under the new laws? What are the highest tax rates in the history of the United States? While these were some interesting tax facts, those who attended Read More

Jul 17, 2018

IRS Encourages Taxpayers to Check Withholding

Are you withholding enough money from your regular paychecks? The Tax Cuts and Jobs Act (TCJA) has made several significant changes to the tax rules for individuals for 2018 through 2025. As a result, many Read More

Jul 06, 2018

Watch Out for these Tax Issues When Planning for Your Business in 2018

The Tax Cuts and Jobs Act makes sweeping changes. Here's a quick reference guide to the major changes under the new law to help you understand what's changing. In general, these changes are effective for tax Read More

Jun 26, 2018

Save or Shred? Follow These Record Keeping Guidelines

Are you a record keeping pack rat? Many individuals and businesses hold onto paper and digital records indefinitely — just in case. But securely storing years of financial records can become burdensome. Here's some guidance to Read More

Apr 17, 2018

How the New Tax Law Affects Rental Real Estate Owners

Do you own residential or commercial rental real estate? The Tax Cuts and Jobs Act (TCJA) brings several important changes that owners of rental properties should understand. In general, rental property owners will enjoy lower Read More

Mar 26, 2018

Big Changes for Individuals who Itemized Deductions

Do you Itemize? The new Tax Cuts and Jobs Act (TCJA) significantly changes some parts of the tax code that relate to personal tax returns. As a result, millions of Americans who have itemized deductions in Read More

Feb 05, 2018