Ensuring Profitability as Your Veterinary Practice Grows

In a thriving pet care industry valued at nearly $36 billion, increasing profitability while growing your veterinary practice can be a challenging endeavor. The path to growth is not just about increasing revenue but understanding Read More

Nov 08, 2023

Year-End Tax Planning For Manufacturers

Implementing year-end tax planning strategies now can help reduce your manufacturing company's 2023 tax bill. Indeed, a lower tax bill can improve your cash flow and your bottom line. One of the most tried-and-true strategies Read More

Nov 07, 2023

Planning a Graceful (and Profitable) Exit from Your Business

At some point, every business owner leaves the company, either voluntarily through retirement or otherwise. Some businesses will outlive their founders. Others can't survive without the continued involvement of a key owner-employee. And a few Read More

Nov 06, 2023

Could Your Organization Benefit from an Interim CFO?

There's currently a talent crisis in the accounting industry. The U.S. Bureau of Labor Statistics estimates that roughly 17% of U.S. accountants and auditors have left their jobs over the past two years, leaving some Read More

Nov 03, 2023

FAQs about SE Tax

Entrepreneurs and others who work for themselves are often on the hook for significant federal self-employment (SE) tax, in addition to federal and state income taxes. Here are the answers to some common questions about Read More

Oct 25, 2023

Coming Soon: Changes to the 401(k) Plan Participation Rules

Years ago, employers could exclude part-time employees — those who work less than 1,000 hours per year in the business — from participating in 401(k) plans. That was before the Setting Every Community Up for Read More

Oct 23, 2023

Six Cash Flow Best Practices for Cyclical Businesses

While cash flow best practices apply across all types of businesses, there’s added difficulty for businesses that experience dramatic fluctuations in sales and cash flow due to the seasonal or cyclical nature of their products Read More

Oct 19, 2023

Leveraging AI to Add Value to Your Business

Artificial intelligence (AI) has been around for years. In November 2022, however, the technology became more broadly used by the general public with the advent of Chat Generative Pre-Trained Transformer (ChatGPT). This conversation bot uses Read More

Oct 12, 2023

10 Ways Construction Companies Can Tighten Up Their Estimates

In a perfect world, initial project estimates would match actual costs at the end of every job — with no hint of cost overruns or profit fade. But, let's be honest, that hardly ever happens. Read More

Oct 10, 2023

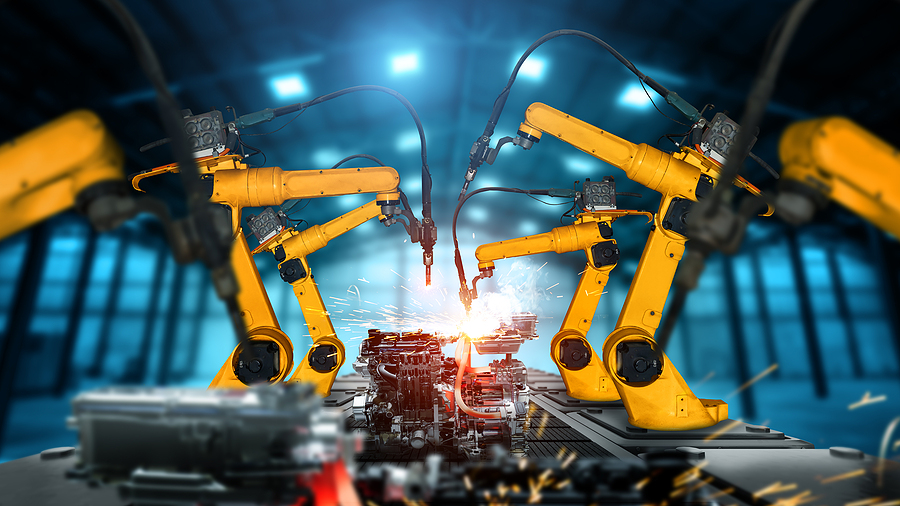

Are You Prepared to Join the Manufacturing 4.0 Revolution?

Manufacturing 4.0, sometimes called "Industry 4.0," refers to the digitalization of manufacturing. That means the integration of traditional manufacturing processes and practices with cutting-edge "smart" technology. How might Manufacturing 4.0 benefit your manufacturing company? According Read More

Oct 10, 2023