What a Business Valuation Is – and Isn’t

When an entire specialty has been built around a single business metric, it suggests a great need in the marketplace. But a need for what, exactly? “Business valuation” sounds like a straightforward concept, but in Read More

Oct 19, 2022

Why Have Your Financial Statements Reviewed (Even When Not Required)

Reviewed financial statements can increase the value of your business and serve you in a multitude of ways Business owners typically field requests for reviewed financial statements for a specific purpose. Whether the requests come Read More

Oct 17, 2022

New Law Enhances Payroll Tax Break for Small Manufacturers’ Research Expenses

Is your manufacturing company on the cutting edge? It's important to keep pace with the competition, especially if you're trying to carve out a niche in a new marketplace. Fortunately, federal tax law allows Read More

Oct 13, 2022

9 Cash-Flow Management Tips for Construction Companies

Construction business owners know that cash is king. However, managing cash flow in an industry known for its ebbs and flows isn't easy. And when you throw in the steady rise of inflation and ongoing Read More

Oct 13, 2022

Cash In on Corporate Deductions for Charitable Donations

Most people already understand the tax rules for individual charitable donations, including generous deductions that may be available to itemizers when they give cash or property to charity. But your business may also reap tax Read More

Oct 13, 2022

How a Valuation Pro Can Help with Business Interruption Claims

A change in seasons can bring extreme weather, including floods, droughts, wildfires, tornadoes and hurricanes. These natural disasters and other crises can interrupt normal business operations, causing significant financial losses. If disaster strikes, a business Read More

Oct 13, 2022

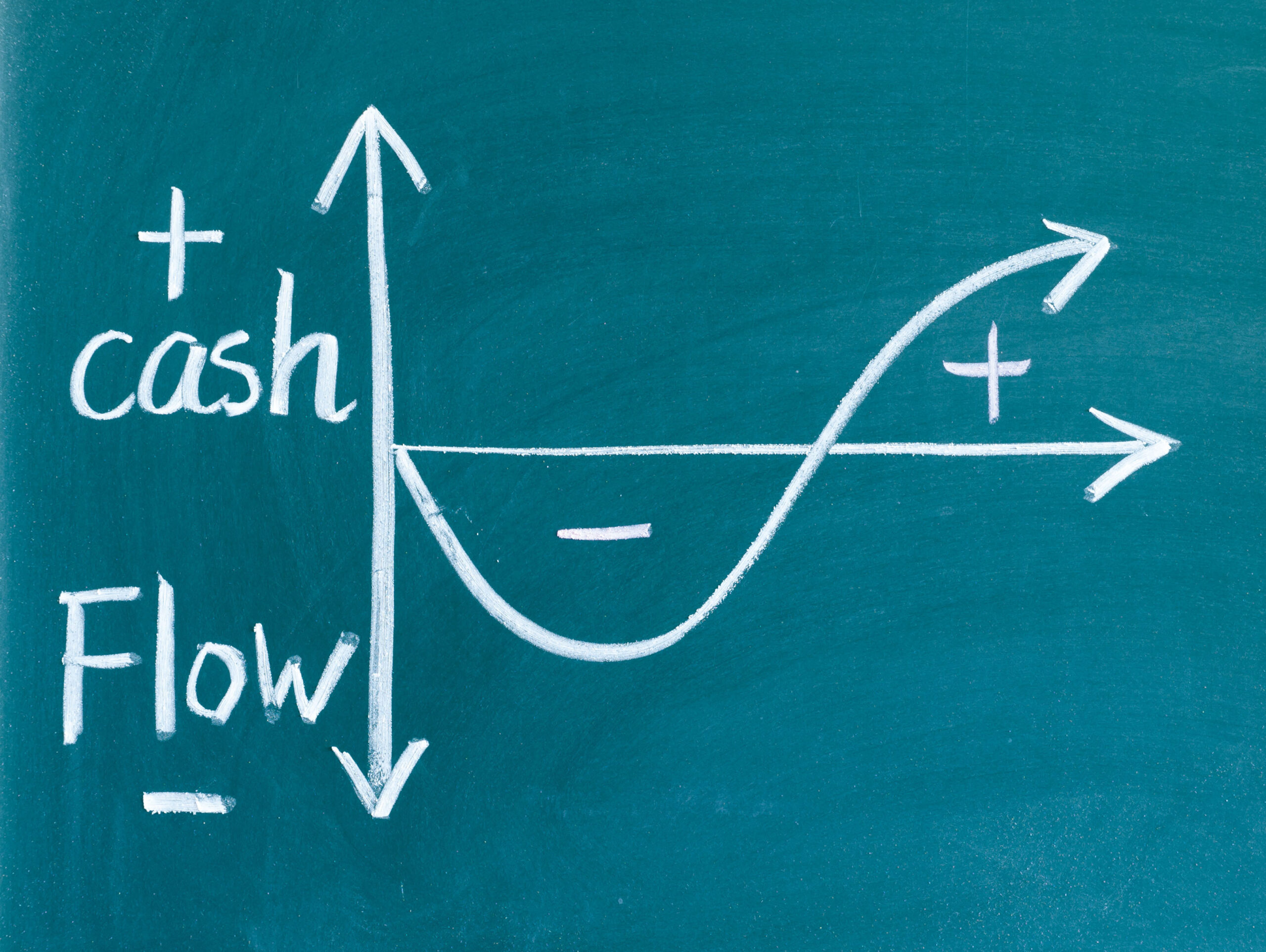

Tips for Recognizing and Solving Cash Flow Problems

There's more to financial reporting than profits. The statement of cash flows can be a powerful management tool. During an economic downturn, it's especially important for managers to monitor cash flows to detect — and Read More

Sep 30, 2022

Accuracy Counts in Inventory Management

Is the amount of inventory on your company's balance sheet accurate? Depending on the nature of a company's operations, its balance sheet may include inventory, consisting of raw materials, work-in-progress and/or finished goods. Inventory items Read More

Sep 30, 2022

Avoid IRA Rollover Tax Traps

An IRA rollover is usually a tax-smart move, because it allows you to continue to defer taxes on the amount you roll over. But Congress has laid traps for the unwary. Here's how to avoid Read More

Sep 28, 2022

Case Study: Strategic Accounting Support from Acquisition to Sale

Download our case study to learn how Kirsch CPA Group supported a Cincinnati entrepreneur from a business acquisition through a successful sale – and everything in-between. The owner and CEO of Cincinnati-based design consultancy Kaleidoscope Read More

Sep 20, 2022