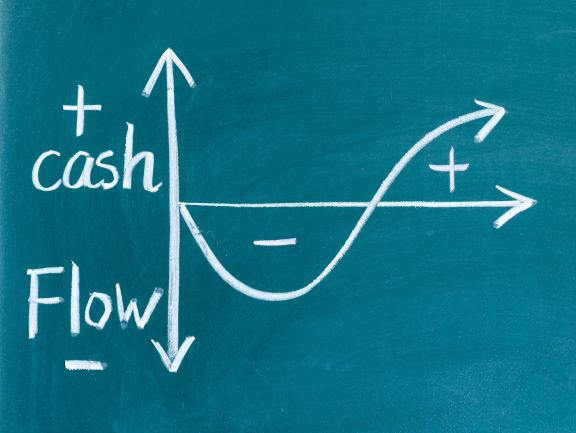

Forecasting Cash Flow for Valuation in COVID-19 Era

Business valuation is a prophecy of the future. That is, investors typically value a business based on its ability to generate future cash flow. The COVID-19 crisis has caused operations to change for many businesses, Read More

Sep 03, 2020

The IRS Releases this Year’s Dirty Dozen Tax Scams

Each year, the IRS compiles a list of 12 common tax scams that taxpayers may encounter during the year. This year, the "dirty dozen" list focuses on scams that target individual taxpayers, with special emphasis Read More

Aug 24, 2020

Monitor These 3 Things as COVID-19 Changes Your Nonprofit’s Priorities

Several months into the COVID-19 crisis, most not-for-profit organizations have formulated at least a temporary plan for sustaining operations. But short-term solutions should be complemented by long-term strategic planning that reprioritizes objectives. Specifically, your nonprofit Read More

Aug 11, 2020

Purchasing a Business Vehicle – What Is Deductible for 2020?

Purchases of a new and used business vehicle may qualify for tax breaks under current tax law. If you need a new vehicle to use for business purposes, review these details before you go shopping. Read More

Aug 11, 2020

5 Mid-Year Tax Planning Tips for Business Owners

The second half of 2020 has begun and it is more important than ever to consider mid-year tax planning ideas. What steps can business owners take today to lower taxes for the current tax year? Read More

Aug 06, 2020

PPP Loan Forgiveness Update

We understand that many PPP borrowers are anxious to get started with the loan forgiveness process for a variety of reasons. Our Covid-19 team has kept completely updated on all guidance issued and stands ready Read More

Jul 29, 2020

FASB Offers Reprieve from Updated Lease and Revenue Recognition Rules

If you're feeling burned out from coping with extreme circumstances brought on by the COVID-19 pandemic, you're not alone. Fortunately, the Financial Accounting Standards Board (FASB) and Congress are offering some compliance-related relief for certain Read More

Jul 23, 2020

Who Will Run Your Business After You?

If you're a business owner, do you have a plan in place that names who'll follow you as head of your company? You may feel you're too busy running the business today to waste time Read More

Jul 23, 2020

COVID-19 Crisis May Affect Tax Angles for Rental Property Losses

The economic fallout from the COVID-19 crisis will cause many rental real estate properties to run up tax losses in 2020 — and possibly beyond. Here's a summary of important federal income tax rules for Read More

Jul 10, 2020

HIPAA Special Enrollment during COVID-19 Emergency

Here's a HIPAA-related question from one employer. Q. How long are the extended HIPAA special enrollment periods during the COVID-19 emergency? A. In response to the COVID-19 emergency, the Department of Labor and IRS issued Read More

Jul 10, 2020