7 Valuable Tax Credits for Small Businesses

Many people are familiar with tax credits for individual taxpayers, such as the credits for higher education expenses or the child tax credit. But businesses and business owners also may be eligible for some valuable Read More

Feb 02, 2023

Where Is My Federal & Ohio Tax Refund for 2020?

Taxpayers have until Wednesday, April 15, 2021, to file their 2020 tax returns and pay any tax due. If you are expecting a tax refund, you can click the link below to quickly learn the status Read More

Mar 06, 2020

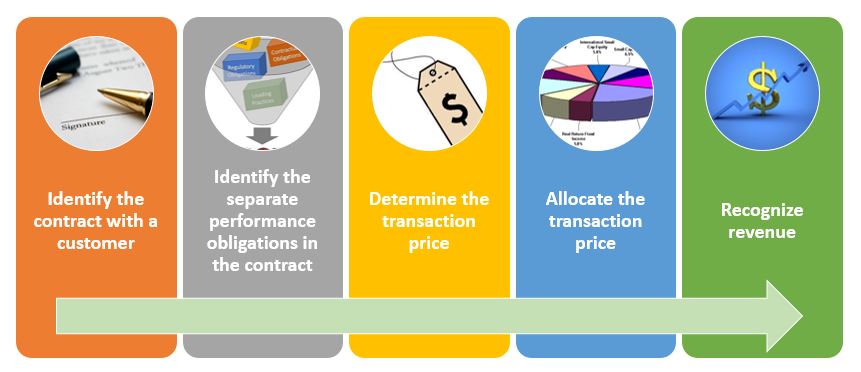

Are you prepared for the new Revenue Recognition standards?

You have heard of Revenue Recognition, and likely know you need to make changes. But WHAT? Here is what you need to know, and how it’s done. What Businesses are impacted by the change Read More

Nov 07, 2019

Kirsch CPA Group Earns National Recognition

Kirsch CPA Group earns national recognition, based on the 2019 annual Public Accounting Survey and Analysis of Firms The team at Kirsch CPA Group, a public accounting firm that specializes in accounting, tax, and advisory Read More

Oct 16, 2019

Announcing Key Employee Promotions to Expand Leadership Team

Kirsch CPA Group is excited to announce the promotion of several key team members. These promotions reflect our company's commitment to excellence. We have built a high performing team that requires we recruit, retain and Read More

Jul 25, 2019

Best Workplaces in Ohio

We are pleased to announce Kirsch CPA Group has been chosen a 2019 Best Workplaces in Ohio Ohio Business Magazine presented the fourth annual Best Workplaces in Ohio, highlighting those companies that are making Read More

Apr 25, 2019

Take advantage of these Tax Day deals

Happy Tax Day! Once your taxes have been filed, first, take a moment to breathe a big sigh of relief…and then enjoy some Tax Day (April 15, 2019) discounts. There’s nothing like a good deal Read More

Apr 15, 2019

Looking for a Business Loan? Be Prepared

If you're building up a small business but haven't yet needed to borrow funds to expand or smooth out cash flow irregularities, you're doing something right. Or if you have borrowed and everything went smoothly, kudos Read More

Oct 15, 2018

Kirsch CPA Group Receives “Best of the Best Firm” Award for 4th Year

The national accounting publication INSIDE Public Accounting (IPA) has recognized that Kirsch CPA Group is one of the 2018 “Best of the Best” CPA firms in the local and regional firm category. This recognition is given to Read More

Oct 02, 2018

Put the Tax Cuts to work for your Business

Do you know the highest individual tax rate under the new laws? What are the highest tax rates in the history of the United States? While these were some interesting tax facts, those who attended Read More

Jul 17, 2018