Manufacturers Should Consider These 7 Midyear Tax-Reduction Moves Now

July marks the halfway point of the year and is generally an ideal time for manufacturers to assess their tax situation and plan appropriate strategies for reducing their 2024 tax liability. Bearing in mind that Read More

Jul 17, 2024

Is Your Inventory Missing — Or Stolen? Ask an Expert

For many businesses, such as retailers, manufacturers and contractors, strict inventory control is central to operations. If you don't track inventory accurately, you can't effectively produce goods, meet customer demand and realize profits. Let's say Read More

Jul 16, 2024

What Can Your Small Business Do Now to Lower Taxes for 2024?

Summer is a good time to take stock of how your small business is doing this year and consider options for reducing your 2024 federal income tax bill. Thankfully, it appears there won't be any Read More

Jul 15, 2024

How Construction Business Owners Can Make Succession Planning Easier

Creating a comprehensive and actionable succession plan is rarely easy for business owners. It's certainly a challenge for most contractors, who may find it difficult to step away from the day-to-day hustle and bustle of Read More

Jul 12, 2024

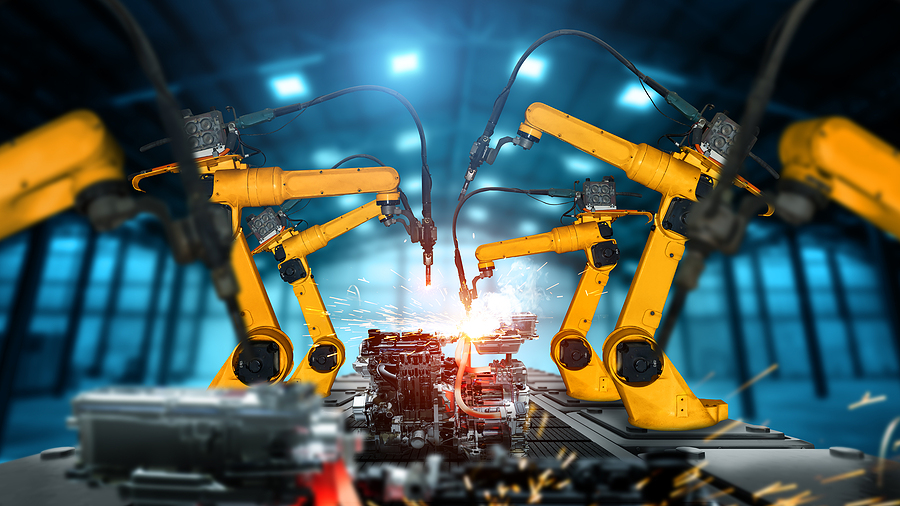

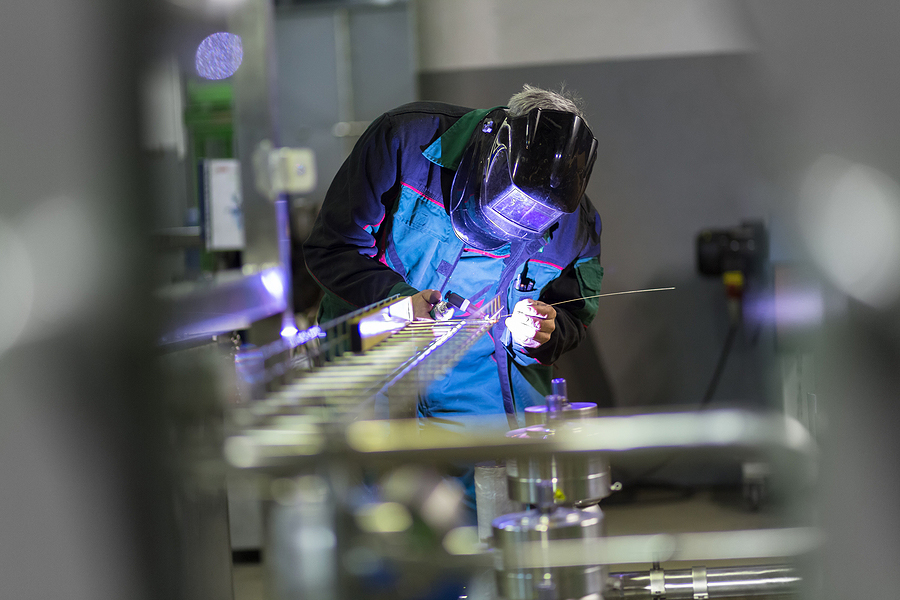

5 Best Practices for Determining the True Cost of Goods Sold for Manufacturers

Manufacturing businesses typically operate on narrow margins, complicated by inventory challenges and material costs over which they have little control. It’s an environment in which a thorough understanding of the true cost of the products Read More

Jul 10, 2024

Business Planning Basics: Why Financial Data Is Essential

Business plans aren't only for young companies seeking initial financing. They can also help established companies make strategic decisions and communicate with lenders and investors when they seek new capital infusions. Here's an overview of Read More

Jul 09, 2024

Business Owners: Understanding Value Is Key to Updating Your Estate Plan

Summer is a great time for business owners to review their estate plans. Maybe your kids are home for summer break, so they're top of mind. Or perhaps you're vacationing with relatives or getting together Read More

Jul 07, 2024

Kirsch CPA Honored as a Finalist for 2024 Greater Cincinnati’s Best Places to Work

At Kirsch CPA, the foundation of our success is a dedicated and passionate team. We are happy to announce that Kirsch CPA is a finalist for Greater Cincinnati’s Best Places to Work award. This is Read More

Jun 26, 2024

Get a Handle on Working Capital

Working capital management is a top priority for businesses today. Consulting firm The Hackett Group's 2023 Working Capital Survey reports that many companies are carrying high amounts of working capital on their balance sheets — Read More

Jun 24, 2024

Valuing Donations of Private Business Stock

Some business owners may be considering donating corporate stock to charities in 2024. Donations of public stocks are generally easy to value because their prices are listed on public stock exchanges. But valuations of private Read More

Jun 17, 2024