Prevent Fraud at Your Construction Company With a Holistic Approach

Most experts would agree that the best way to minimize fraud at any company, including a construction business, is to take a holistic approach. As the owner, you must set the tone at the top Read More

Nov 30, 2022

Financial Reporting Check-Up: How Fiscally Fit Is Your Company?

Comprehensive financial statements prepared under U.S. Generally Accepted Accounting Principles (GAAP) include three reports: the balance sheet, income statement, and statement of cash flows. Together these reports can be powerful diagnostic tools to help evaluate Read More

Nov 30, 2022

The IRS Has Announced Various Tax Benefit Increases for 2023

The IRS recently announced many inflation adjustments for the 2023 tax year. IRS Revenue Procedure 2022-38 provides details about these amounts. Because inflation is high, many of the amounts for 2023 will change more than they Read More

Nov 30, 2022

Manufacturers Must Act Now to Maximize Depreciation-Related Tax Breaks for 2022

As the end of the year nears, manufacturers are looking to get the most tax bang for their buck. One proven method is to maximize tax breaks relating to depreciation. In some cases, your company Read More

Nov 09, 2022

It’s Time for Businesses to Rethink Their Working Capital Practices

In today's uncertain marketplace, businesses are being forced to re-evaluate their working capital needs. Some managers have learned the hard way during the pandemic that operating "lean" has its limits. What Is Working Capital? Read More

Nov 09, 2022

How Can Small Business Owners Lower Taxes for 2022?

It's time for year-end tax planning. Every fall, small business owners should review their tax situations to determine steps they should consider to reduce their federal income taxes for the current year — and beyond. Read More

Oct 27, 2022

Employers: Beware of Improper Employee Retention Credit Claims

The IRS is warning employers to beware of third parties who are advising them to claim the Employee Retention Credit (ERC) when they may not qualify. Some third parties are taking improper positions related to Read More

Oct 27, 2022

Social Security Wage Base and Earnings Test Amounts Increase in 2023

The Social Security Administration (SSA) recently announced that the "wage base" for computing Social Security tax will increase for 2023 to $160,200. This is up from $147,000 for 2022. Federal law limits the amount of Read More

Oct 27, 2022

New Law Enhances Payroll Tax Break for Small Manufacturers’ Research Expenses

Is your manufacturing company on the cutting edge? It's important to keep pace with the competition, especially if you're trying to carve out a niche in a new marketplace. Fortunately, federal tax law allows Read More

Oct 13, 2022

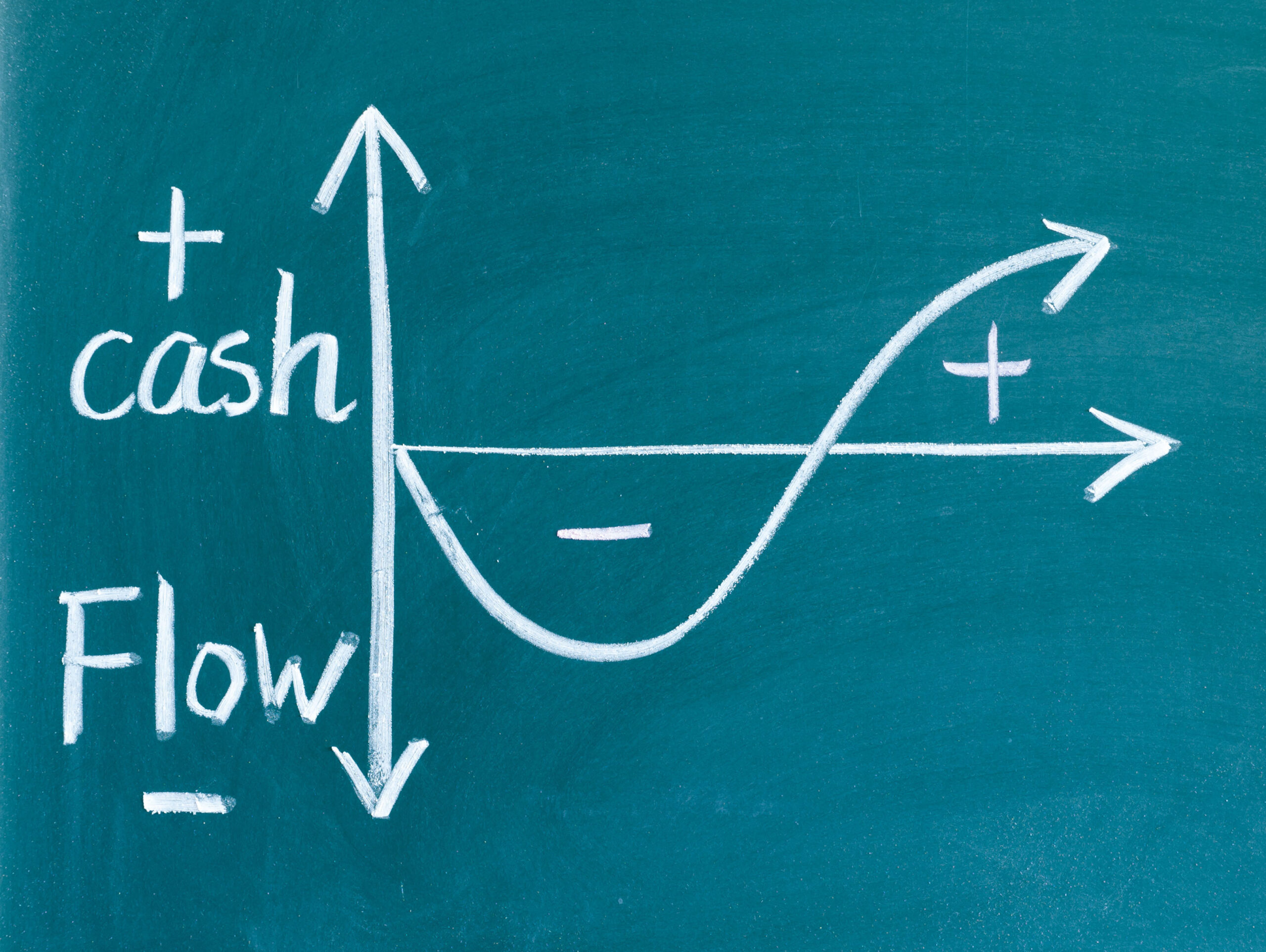

9 Cash-Flow Management Tips for Construction Companies

Construction business owners know that cash is king. However, managing cash flow in an industry known for its ebbs and flows isn't easy. And when you throw in the steady rise of inflation and ongoing Read More

Oct 13, 2022