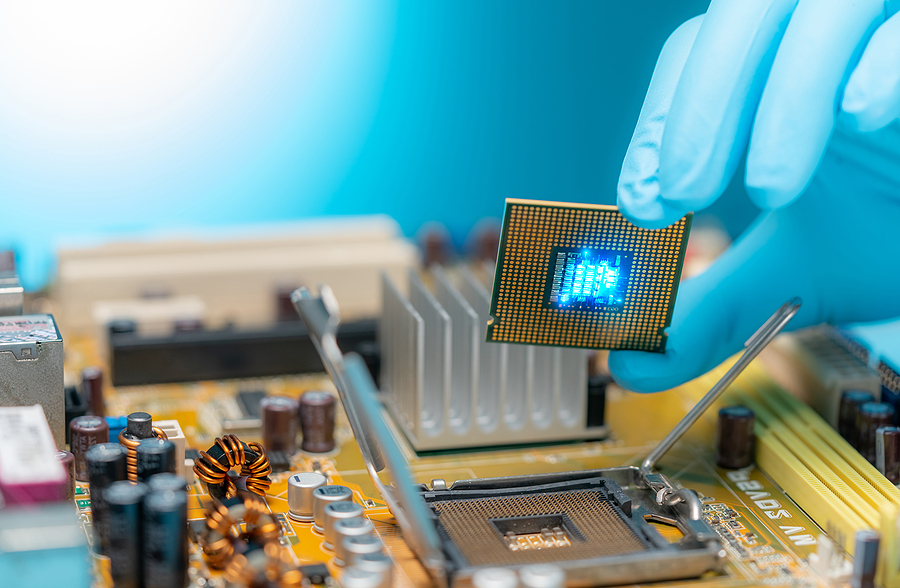

IRS Issues Guidance for Manufacturers on New Semiconductor Tax Credit

The IRS has released proposed regulations that provide guidance for manufacturers on the implementation of the Advanced Manufacturing Investment Credit. The credit, created by the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act, encourages manufacturers Read More

Apr 12, 2023

Supreme Court Rejects Claim for Exemption from Overtime Pay

Employers and employees are often at odds over the issue of overtime pay. Naturally, employers are inclined to argue that an employee isn't entitled to overtime pay when it would boost the overall compensation that Read More

Apr 11, 2023

Beefing Up Benefits May Save Tax Dollars for Construction Businesses

Construction companies continue to find themselves embroiled in a protracted battle for skilled labor. One fundamental way to recruit the best talent and retain valued employees is by offering competitive compensation and benefits. Let's focus Read More

Apr 10, 2023

How Much FDIC Coverage Do You Have?

In early March, Silicon Valley Bank (SVB) and Signature Bank unexpectedly collapsed. They became the second and third largest bank failures in U.S. history, respectively. The largest collapse involved Washington Mutual in 2008, precipitating the Read More

Mar 27, 2023

Fraud Alert: Scammers are requesting account changes

The banking industry is reporting a significant increase in account fraud. A high number of instances are being reported where scammers reach out to businesses via email posing as a client or vendors informing them Read More

Mar 17, 2023

Fuel Your Business Growth with Outsourced CFO & Controller Services

Solid accounting is the cornerstone of growing a business. Yet many small and mid-sized businesses do without key financial insights because they think their needs are not big enough to justify the expense of hiring Read More

Mar 15, 2023

Is Your Financial Reporting on Target?

While your P&L paints a broad picture of financial viability, it may not be telling you the whole story. Too often, businesses have a financial reporting structure that makes it difficult to identify what’s driving Read More

Mar 10, 2023

Empower Your Business with a Streamlined Month-End Close Process

As a business owner, you face endless, competing priorities. One priority that shouldn’t be overlooked – and that can truly change your business for the better – is the month-end closing of your books. An Read More

Mar 02, 2023

Navigate to Your Goals with Financial GPS

Few business owners don’t see value in taking time to scrutinize their financial statements, especially at the end of the year. But do they take the time to do so? And when you, or your Read More

Jan 20, 2023

Financial Reporting Check-Up: How Fiscally Fit Is Your Company?

Comprehensive financial statements prepared under U.S. Generally Accepted Accounting Principles (GAAP) include three reports: the balance sheet, income statement, and statement of cash flows. Together these reports can be powerful diagnostic tools to help evaluate Read More

Nov 30, 2022