Six Cash Flow Best Practices for Cyclical Businesses

While cash flow best practices apply across all types of businesses, there’s added difficulty for businesses that experience dramatic fluctuations in sales and cash flow due to the seasonal or cyclical nature of their products Read More

Oct 19, 2023

Leveraging AI to Add Value to Your Business

Artificial intelligence (AI) has been around for years. In November 2022, however, the technology became more broadly used by the general public with the advent of Chat Generative Pre-Trained Transformer (ChatGPT). This conversation bot uses Read More

Oct 12, 2023

10 Ways Construction Companies Can Tighten Up Their Estimates

In a perfect world, initial project estimates would match actual costs at the end of every job — with no hint of cost overruns or profit fade. But, let's be honest, that hardly ever happens. Read More

Oct 10, 2023

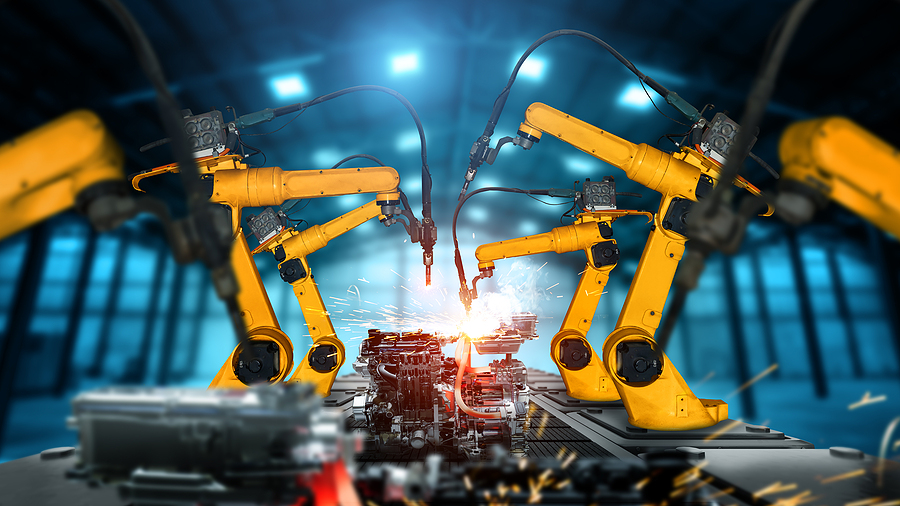

Are You Prepared to Join the Manufacturing 4.0 Revolution?

Manufacturing 4.0, sometimes called "Industry 4.0," refers to the digitalization of manufacturing. That means the integration of traditional manufacturing processes and practices with cutting-edge "smart" technology. How might Manufacturing 4.0 benefit your manufacturing company? According Read More

Oct 10, 2023

What the DOL’s Overtime Pay Proposal Could Mean for Employers

A new rule proposed by President Biden and released by the U.S. Dept. of Labor (DOL) in August would result in an estimated 3.6 million additional workers qualifying for overtime pay — even though they're Read More

Oct 09, 2023

What’s the Proper Tax Treatment for Intangible Assets?

Intangible assets have become increasingly vital to the value of many companies. While their benefits may be obvious to business owners, their tax treatment often isn't. Taxpayers may be surprised by the expansive IRS definition Read More

Sep 26, 2023

Understanding the CPA’s Role in Detecting Fraud

A role of CPA's is to act as "gatekeepers," emphasizing their responsibilities for identifying fraud risks and detecting material misstatements in the financial statements. These responsibilities are currently at the forefront due to changes to Read More

Sep 25, 2023

Partnerships: Tax Considerations When Adding a New Partner

Are you considering inviting an employee or an outsider to participate in your existing partnership? Before making any commitments, it's important for you and the prospective partner to understand the potential federal tax implications. Important: Read More

Sep 22, 2023

IRS Orders an Immediate Stop to New Employee Retention Tax Credit Processing

After receiving a deluge of improper Employee Retention Tax Credit (ERTC) claims, the IRS recently announced an immediate moratorium through at least December 31 on processing new claims for the pandemic relief program. The tax Read More

Sep 20, 2023

7 Questions Contractors Should Ask Before Seeking Outside Financing

Construction companies can leverage loans, lines of credit and other such products to help ensure positive cash flow, build creditworthiness and fuel business growth. But the options can seem limitless and overwhelming. Here are seven Read More

Sep 08, 2023