What Employers Should Know about HSAs

Health Savings Accounts (HSAs) are a tax-smart way to cover an individual's uninsured medical expenses, as well as certain other out-of-pocket medical, dental, vision, hearing, long-term care expenses and insurance premiums. Your business can set Read More

Jan 13, 2020

Estate Planning Isn’t Just for the Rich and Famous

Nearly everyone should consider updating his or her estate plan. This is smart advice even if you're not currently exposed to the federal estate tax. Year-end can be a convenient time to reflect on major Read More

Jan 07, 2020

FAQs About Self-Employment Tax

Do you owe self-employment (SE) tax on non-wage income that you collect only occasionally or in a one-off circumstance? Some sources of income may not be subject to the dreaded SE tax. Here's what you Read More

Jan 03, 2020

FAQs about Home Office Deductions

In the past, home office deductions were available to a wide range of taxpayers, including certain employees who worked from home. But the Tax Cuts and Jobs Act (TCJA) has effectively eliminated home office deductions Read More

Jan 01, 2020

Tied Down to Your 401(k) Plan’s Cost? Discover the Alternatives

Before 401(k) plans burst onto the employee benefit scene in the 1980s and traditional pension plans had not yet gone nearly extinct, there were profit-sharing plans. The purpose of these plans, as the name suggests, Read More

Dec 31, 2019

Estate Planning – Does it still matter?

Estate planning isn't just for the rich and famous. Many people mistakenly think that they don't need an estate plan anymore because of the latest tax law changes. While it's true that the Tax Cuts Read More

Oct 29, 2019

Prepare to Receive a Social Security Administration No-Match Letter

The SSA explains that it's seeking to reconcile discrepancies between the names and Social Security Numbers (SSNs) it has on file with the names and SSNs that employers report. The purpose isn't to support enforcement Read More

Oct 15, 2019

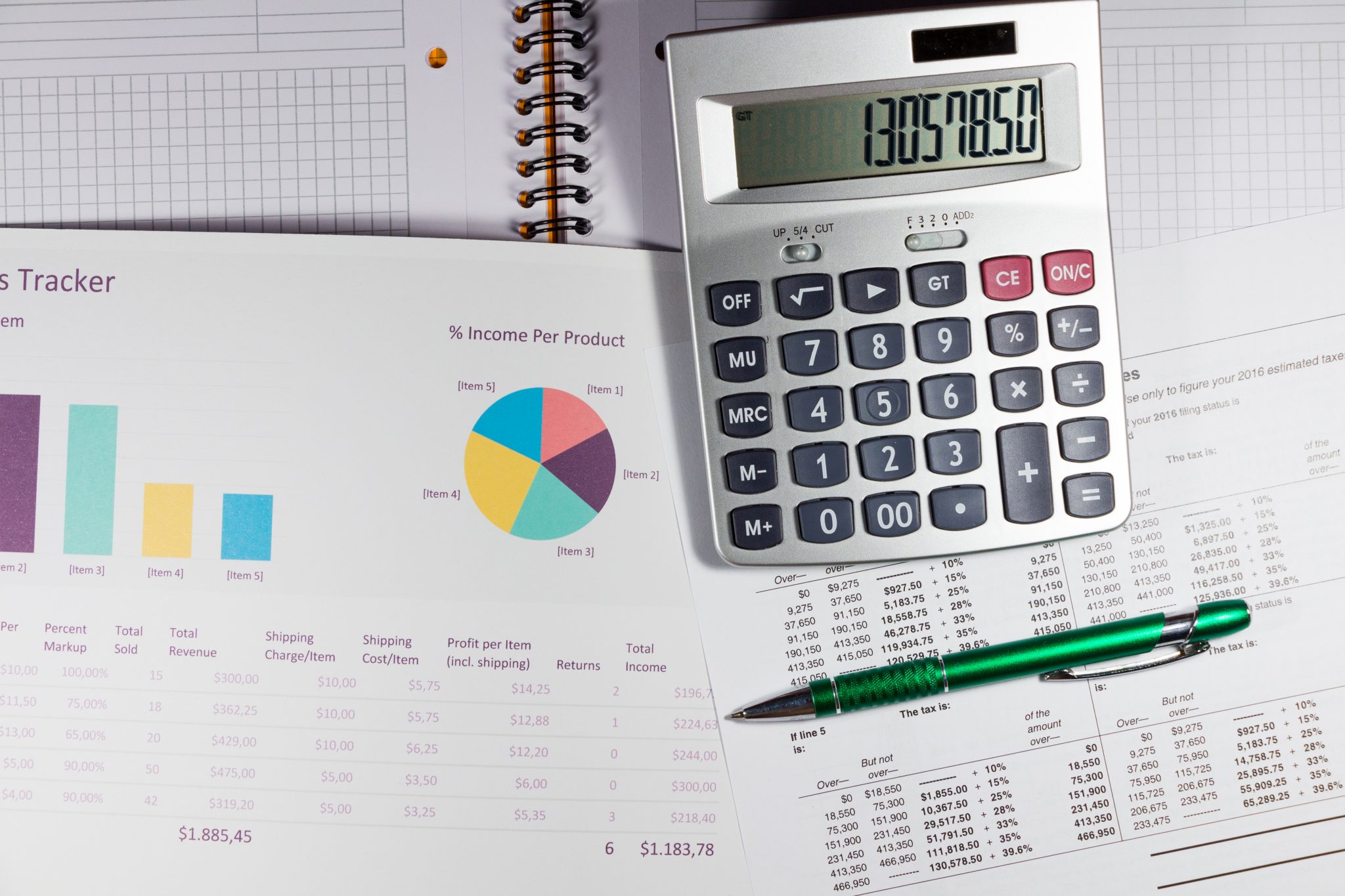

Tax Planning Strategies to Reduce AGI

Reducing your current-year adjusted gross income (AGI) is usually a tax-smart idea. Here are ten tax planning strategies to reduce your AGI (and modified AGI) over the short and long run. Closeup on AGI Read More

Oct 15, 2019

New Overtime Pay Rules Finalized for 2020

The U.S. Department of Labor (DOL) has issued the long-anticipated final version of its overtime eligibility rules. The changes will take effect on January 1, 2020. As a result, the DOL estimates that 1.3 million Read More

Oct 15, 2019

Guidance on Independent Contractor Status

The so-called "gig economy" challenges conventional practices between companies and the people who perform the work. A key question is: Are these workers an independent contractor or employee? The U.S. Department of Labor (DOL) recently Read More

Jul 19, 2019