1099 Deadline is Looming

As the 1099 deadlines loom closer, one of the questions we are asked by entrepreneurs every year is whether or not they need to send out 1099s to their contractors. 1099 tax form should be Read More

Jan 23, 2020

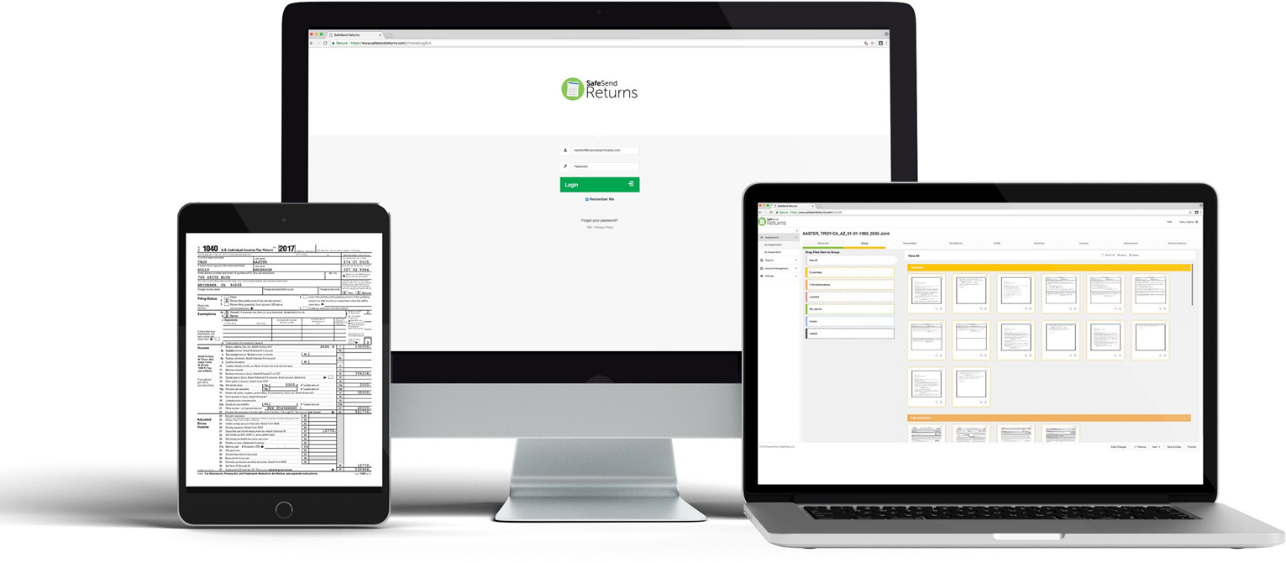

Introducing SafeSend Returns for Secure Delivery

UTILIZING TECHNOLOGY SOLUTIONS TO BETTER SERVE YOUR NEEDS Kirsch CPA Group is introducing SafeSend Returns™, an electronic system that automates the Delivery of Tax Returns to our clients. SafeSend Returns offers our clients an easier to Read More

Jan 13, 2020

What Employers Should Know about HSAs

Health Savings Accounts (HSAs) are a tax-smart way to cover an individual's uninsured medical expenses, as well as certain other out-of-pocket medical, dental, vision, hearing, long-term care expenses and insurance premiums. Your business can set Read More

Jan 13, 2020

Estate Planning Isn’t Just for the Rich and Famous

Nearly everyone should consider updating his or her estate plan. This is smart advice even if you're not currently exposed to the federal estate tax. Year-end can be a convenient time to reflect on major Read More

Jan 07, 2020

FAQs about Home Office Deductions

In the past, home office deductions were available to a wide range of taxpayers, including certain employees who worked from home. But the Tax Cuts and Jobs Act (TCJA) has effectively eliminated home office deductions Read More

Jan 01, 2020

Tied Down to Your 401(k) Plan’s Cost? Discover the Alternatives

Before 401(k) plans burst onto the employee benefit scene in the 1980s and traditional pension plans had not yet gone nearly extinct, there were profit-sharing plans. The purpose of these plans, as the name suggests, Read More

Dec 31, 2019

Charting a Change in Culture

Every not-for-profit develops a culture over time, often defining the organization. However, even if your group's been successful in the past, a change in culture could be a change for the better. Warning Signs Read More

Dec 30, 2019

How Industry Fits Into the Valuation Puzzle

IRS Revenue Ruling 59-60 is an essential building block of modern appraisal practice. It identifies "the condition and outlook of the specific industry" as one of the factors to consider when valuing a private business. Read More

Dec 27, 2019

Negotiating the Sales Deal

A good salesperson is usually able to get to the negotiating table. Once there, however, it takes a great salesperson to close the deal. The difference often comes down to an ability to negotiate skillfully. Read More

Oct 31, 2019

Estate Planning – Does it still matter?

Estate planning isn't just for the rich and famous. Many people mistakenly think that they don't need an estate plan anymore because of the latest tax law changes. While it's true that the Tax Cuts Read More

Oct 29, 2019