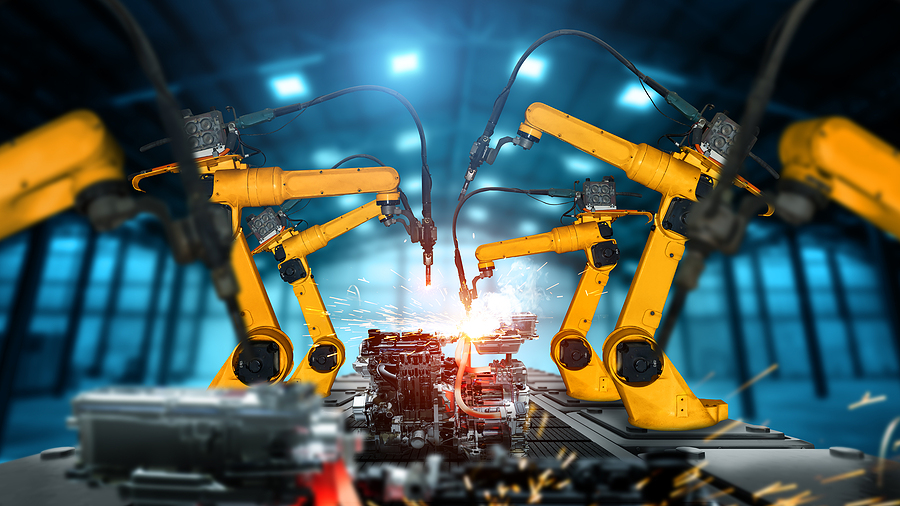

Avoiding the Mistakes Manufacturing Growth Can Hide

Running a successful manufacturing business requires so many things to go right, from navigating hiring shortages and global supply chain logistics to market forecasting and the challenges of digital transformation. When your business is growing, Read More

Aug 21, 2024

Business Owners: Failure to Substantiate Donations Can Be Costly

Charitable donations can provide businesses with significant tax savings. But for gifts over a certain amount, they must obtain a contemporaneous written acknowledgement of their donations to qualify for a charitable contribution deduction. Failing to Read More

Aug 19, 2024

Don’t Overlook the Extra Medicare Payroll Tax

Federal payroll taxes are a necessary evil for both employers and employees. Under the Federal Insurance Contributions Act (FICA), employees must pay Social Security and Medicare taxes. For their part, employers must withhold the tax Read More

Aug 15, 2024

Cash Flow Management for Construction Businesses

Construction companies have always faced challenges when it comes to cash flow. The difficulty largely springs from the often-lengthy gaps between winning projects, doing the work and receiving payments. As a result, it's critical for Read More

Aug 07, 2024

How to Protect Your Business from Payroll Fraud Schemes

Payroll fraud is a threat to any business that pays employees or contractors. Unfortunately, this type of financial crime can go undetected for months — even years — and inflict significant losses. Findings from Read More

Aug 06, 2024

Forecasting Your Nonprofit’s Financial Future

Have you seen the forecast? No, not the weather forecast — but your not-for-profit's financial forecast. Financial forecasting is critical to any organization's good health, but it can be more difficult for nonprofits than for Read More

Aug 05, 2024

A Business Valuator Is a Must-Have When Filing a Business Interruption Claim

Meteorologists warn that the 2024 hurricane season could break records, possibly surpassing 2020, the worst hurricane season on record. Even if hurricanes aren't a threat where your business operates, other natural disasters — such as Read More

Aug 01, 2024

Levels of Assurance: What’s Right for Your Business?

Does your company use an external accountant to prepare its financial statements? There are several services CPAs offer that provide different levels of assurance. This term refers to how much confidence lenders and other stakeholders Read More

Jul 29, 2024

Manufacturers Should Consider These 7 Midyear Tax-Reduction Moves Now

July marks the halfway point of the year and is generally an ideal time for manufacturers to assess their tax situation and plan appropriate strategies for reducing their 2024 tax liability. Bearing in mind that Read More

Jul 17, 2024

Is Your Inventory Missing — Or Stolen? Ask an Expert

For many businesses, such as retailers, manufacturers and contractors, strict inventory control is central to operations. If you don't track inventory accurately, you can't effectively produce goods, meet customer demand and realize profits. Let's say Read More

Jul 16, 2024