In a perfect world, initial project estimates would match actual costs at the end of every job — with no hint of cost overruns or profit fade. But, let’...

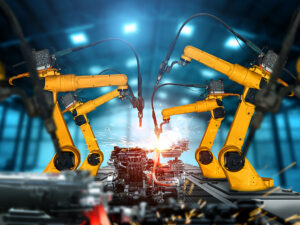

Are You Prepared to Join the Manufacturing 4.0 Revolution?

Oct 10, 2023Manufacturing 4.0, sometimes called “Industry 4.0,” refers to the digitalization of manufacturing. That means the integration of traditional manufac...

What the DOL’s Overtime Pay Proposal Could Mean for Employers

Oct 09, 2023A new rule proposed by President Biden and released by the U.S. Dept. of Labor (DOL) in August would result in an estimated 3.6 million additional workers quali...

Will Your Crypto Transactions Be Reported on a Form 1099?

Oct 06, 2023Some taxpayers may be unaware of all the federal tax reporting requirements for cryptocurrency transactions — especially when it comes to issuing and receivin...

What’s the Proper Tax Treatment for Intangible Assets?

Sep 26, 2023Intangible assets have become increasingly vital to the value of many companies. While their benefits may be obvious to business owners, their tax treatment oft...

Understanding the CPA’s Role in Detecting Fraud

Sep 25, 2023A role of CPA’s is to act as “gatekeepers,” emphasizing their responsibilities for identifying fraud risks and detecting material misstatement...

Partnerships: Tax Considerations When Adding a New Partner

Sep 22, 2023Are you considering inviting an employee or an outsider to participate in your existing partnership? Before making any commitments, it’s important for you...

IRS Orders an Immediate Stop to New Employee Retention Tax Credit Processing

Sep 20, 2023After receiving a deluge of improper Employee Retention Tax Credit (ERTC) claims, the IRS recently announced an immediate moratorium through at least December 3...

7 Questions Contractors Should Ask Before Seeking Outside Financing

Sep 08, 2023Construction companies can leverage loans, lines of credit and other such products to help ensure positive cash flow, build creditworthiness and fuel business g...

New Upcoming Requirement for Businesses that Receive Large Amounts of Cash

Sep 07, 2023Does your business receive large amounts of cash or cash equivalents? If so, you’re generally required to report these transactions to the IRS — and not...