Payroll fraud is a threat to any business that pays employees or contractors. Unfortunately, this type of financial crime can go undetected for months — even ...

Spotlight: The One Big Beautiful Bill Act

Learn how the One Big Beautiful Bill Act impacts businesses and accounting practices. Explore insights, resources, and expert analysis on this important legislation.

Forecasting Your Nonprofit’s Financial Future

Aug 05, 2024Have you seen the forecast? No, not the weather forecast — but your not-for-profit’s financial forecast. Financial forecasting is critical to any organi...

A Business Valuator Is a Must-Have When Filing a Business Interruption Claim

Aug 01, 2024Meteorologists warn that the 2024 hurricane season could break records, possibly surpassing 2020, the worst hurricane season on record. Even if hurricanes aren&...

Levels of Assurance: What’s Right for Your Business?

Jul 29, 2024Does your company use an external accountant to prepare its financial statements? There are several services CPAs offer that provide different levels of assuran...

Ohio Sales Tax Holiday: What Small Business Owners Need to Know

Jul 25, 2024Ohio’s 2024 sales tax holiday is an opportunity for small business owners to attract more customers and boost sales. This year, the annual sales tax holid...

Meet Our Newly Promoted Team Members

Jul 25, 2024Celebrating the Success of our Team Acknowledging the growth and dedication of our team members is a cornerstone of our firm’s success. This summer, we ar...

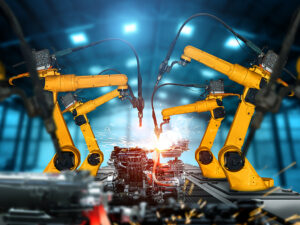

Manufacturers Should Consider These 7 Midyear Tax-Reduction Moves Now

Jul 17, 2024July marks the halfway point of the year and is generally an ideal time for manufacturers to assess their tax situation and plan appropriate strategies for redu...

Is Your Inventory Missing — Or Stolen? Ask an Expert

Jul 16, 2024For many businesses, such as retailers, manufacturers and contractors, strict inventory control is central to operations. If you don’t track inventory acc...

What Can Your Small Business Do Now to Lower Taxes for 2024?

Jul 15, 2024Summer is a good time to take stock of how your small business is doing this year and consider options for reducing your 2024 federal income tax bill. Thankfull...

How Construction Business Owners Can Make Succession Planning Easier

Jul 12, 2024Creating a comprehensive and actionable succession plan is rarely easy for business owners. It’s certainly a challenge for most contractors, who may find ...