Fraud perpetrated by employees, management, vendors or customers can happen to any business. And if it does, it can take years to recover from the financial los...

Got Fraud? Call a Forensic Accountant

Need a CFO? Hire or Outsource

Apr 28, 2023Small business owners often have accounting questions and financial advisory needs that don’t always occur at regular intervals or around tax time. Opportunit...

Resist Purging After Filing Your 2022 Tax Return

Apr 27, 2023The statute of limitations for the IRS to audit your tax return is typically three years. It begins on the later of: 1) the due date for your tax return or 2) t...

How External Auditors Can Leverage Your Internal Audit Work

Apr 26, 2023If your organization has an internal audit function, you may be able to use your internal audit team to streamline financial reporting by external auditors. Ext...

New SECURE 2.0 Act Boosts 401(k) Benefits

Apr 25, 2023The 401(k) plan is the most popular employer-sponsored retirement plan in the United States. As of September 30, 2022, more than $6.3 trillion in assets were he...

Measuring Fair Value for Financial Reporting Purposes

Apr 12, 2023Fair market value is the appropriate standard of value in most business valuation assignments. But when valuing an asset for financial reporting purposes, fair ...

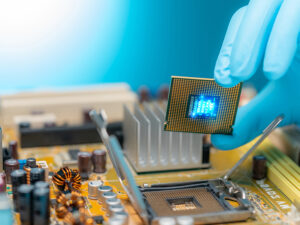

IRS Issues Guidance for Manufacturers on New Semiconductor Tax Credit

Apr 12, 2023The IRS has released proposed regulations that provide guidance for manufacturers on the implementation of the Advanced Manufacturing Investment Credit. The cre...

Supreme Court Rejects Claim for Exemption from Overtime Pay

Apr 11, 2023Employers and employees are often at odds over the issue of overtime pay. Naturally, employers are inclined to argue that an employee isn’t entitled to ov...

Beefing Up Benefits May Save Tax Dollars for Construction Businesses

Apr 10, 2023Construction companies continue to find themselves embroiled in a protracted battle for skilled labor. One fundamental way to recruit the best talent and retain...

Understanding Business Valuation & Finding the Right Buyer

Mar 30, 2023For growth-minded business owners, a valuation is one of the most important financial tools available as it will help you understand what someone might be willi...