The One Big Beautiful Bill Act (OBBBA) has garnered headlines for extending dozens of tax provisions and creating new tax-saving opportunities for individuals a...

Spotlight: The One Big Beautiful Bill Act

Learn how the One Big Beautiful Bill Act impacts businesses and accounting practices. Explore insights, resources, and expert analysis on this important legislation.

Why You May Want to Rethink Your Deduction Strategy in 2025

Oct 21, 2025As we approach the end of 2025, it’s time to evaluate your year-end tax planning strategies. One important decision is whether you’ll claim the stan...

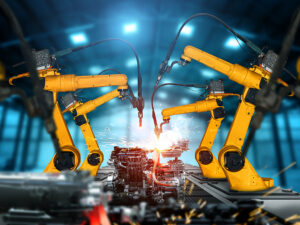

7 Cash Flow Tips for Manufacturers

Oct 17, 2025When times are good, manufacturers tend to focus on sales, profitability and growth. Strong growth can conceal cash flow issues. Cash flow is the lifeblood of a...

Employers: Avoid Tax Surprises When Making Holiday Gifts to Employees

Oct 14, 2025As the year draws to a close, many businesses look for ways to recognize and thank their employees. From gift cards to holiday treats to service awards, the opt...

Accountable Plans: Reimburse Employees the Tax-Smart Way

Oct 13, 2025In many types of businesses, it’s common for employees to spend money on behalf of the company — such as for travel, client meals or supplies. How those...

Introducing Kirsch New Hires

Oct 10, 2025The Kirsch Team is growing, and we’re excited to introduce five talented professionals joining us in 2025. Their skills and dedication will help us continue t...

New Auto Loan Interest Deduction: Limited Opportunity for 2025–2028

Oct 09, 2025For tax years 2025 through 2028, there’s a new tax break that could save you money if you finance a new vehicle for personal use. You can deduct up to $10,000...

Larger QBI Deductions Will Soon Be Available to Many Manufacturers

Oct 07, 2025In a 2024 National Association of Manufacturers (NAM) survey, 93% of respondents who operate as pass-through entities stated that the impending expiration of th...

9 Cash Flow Tips for Construction Businesses

Oct 03, 2025With tariffs, interest rates and other factors continuing to drive economic uncertainty, cash flow management should be a top priority for construction business...

How the QSB Stock Sale Rules Have Become More Favorable

Oct 01, 2025Qualified small business (QSB) stock has received very favorable federal income tax treatment for many years. Starting in 2025, the One Big Beautiful Bill Act (...