The statute of limitations for the IRS to audit your tax return is typically three years. It begins on the later of: 1) the due date for your tax return or 2) t...

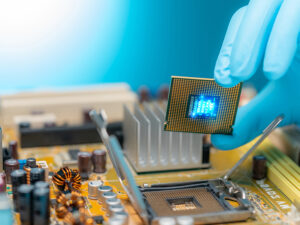

IRS Issues Guidance for Manufacturers on New Semiconductor Tax Credit

Apr 12, 2023The IRS has released proposed regulations that provide guidance for manufacturers on the implementation of the Advanced Manufacturing Investment Credit. The cre...

The IRS Has Announced Various Tax Benefit Increases for 2023

Nov 30, 2022The IRS recently announced many inflation adjustments for the 2023 tax year. IRS Revenue Procedure 2022-38 provides details about these amounts. Because inflat...

Employers: Beware of Improper Employee Retention Credit Claims

Oct 27, 2022The IRS is warning employers to beware of third parties who are advising them to claim the Employee Retention Credit (ERC) when they may not qualify. Some third...

The Wide-Ranging Inflation Reduction Act Is Signed Into Law

Aug 18, 2022Congress has passed the Inflation Reduction Act (IRA) and President Biden signed it into law on August 16. The $740 billion law contains many tax breaks and rai...

Good News: IRS Boosts Standard Mileage Rates for Second Half of 2022

Jun 23, 2022The IRS recently announced it will be increasing the standard mileage rate for qualified business drivers for the second half of 2022. The adjustment reflects r...

How to Make Filing Your Taxes a Non-Event

Oct 13, 2021How did your last tax filing go? Were you stressed out? Surprised by a big tax bill? Angry at your accountant? If you’re like many business owners, filing you...

Would Your Company Pass the Independent Investor Test?

Sep 30, 2021The IRS is planning to crack down on tax evasion to help fund the Biden administration’s ambitious economic agenda. Specifically, the White House hopes to...

The IRS Releases this Year’s Dirty Dozen Tax Scams

Aug 24, 2020Each year, the IRS compiles a list of 12 common tax scams that taxpayers may encounter during the year. This year, the “dirty dozen” list focuses on...