Is your manufacturing company on the cutting edge? It’s important to keep pace with the competition, especially if you’re trying to carve out...

9 Cash-Flow Management Tips for Construction Companies

Oct 13, 2022Construction business owners know that cash is king. However, managing cash flow in an industry known for its ebbs and flows isn’t easy. And when you thro...

Cash In on Corporate Deductions for Charitable Donations

Oct 13, 2022Most people already understand the tax rules for individual charitable donations, including generous deductions that may be available to itemizers when they giv...

How a Valuation Pro Can Help with Business Interruption Claims

Oct 13, 2022A change in seasons can bring extreme weather, including floods, droughts, wildfires, tornadoes and hurricanes. These natural disasters and other crises can int...

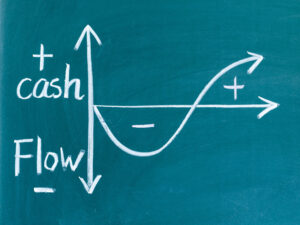

Tips for Recognizing and Solving Cash Flow Problems

Sep 30, 2022There’s more to financial reporting than profits. The statement of cash flows can be a powerful management tool. During an economic downturn, it’s e...

Accuracy Counts in Inventory Management

Sep 30, 2022Is the amount of inventory on your company’s balance sheet accurate? Depending on the nature of a company’s operations, its balance sheet may includ...

Find the Payroll Support You Need from Someone that Already Knows You

Sep 28, 2022For many owners of small and mid-size businesses, taking care of your employees is the highest priority. Paying your team accurately, timely and without hassle ...

Avoid IRA Rollover Tax Traps

Sep 28, 2022An IRA rollover is usually a tax-smart move, because it allows you to continue to defer taxes on the amount you roll over. But Congress has laid traps for the u...

Does Your Business Qualify for the Employee Retention Credit (ERC)?

Sep 28, 2022The Employee Retention Credit (“ERC”) was originally enacted as part of the first wave of pandemic relief in March of 2020. Since then, it has been modified...

Kirsch CPA Group Named Best of the Best for 2022

Sep 22, 2022For nearly 30 years, INSIDE Public Accounting (IPA) has been unveiling its list of the Best of the Best Public Accounting Firms in the nation. Kirsch CPA Gr...