9 Cash-Flow Management Tips for Construction Companies

Kirsch CPA Group

Jun 18, 2025

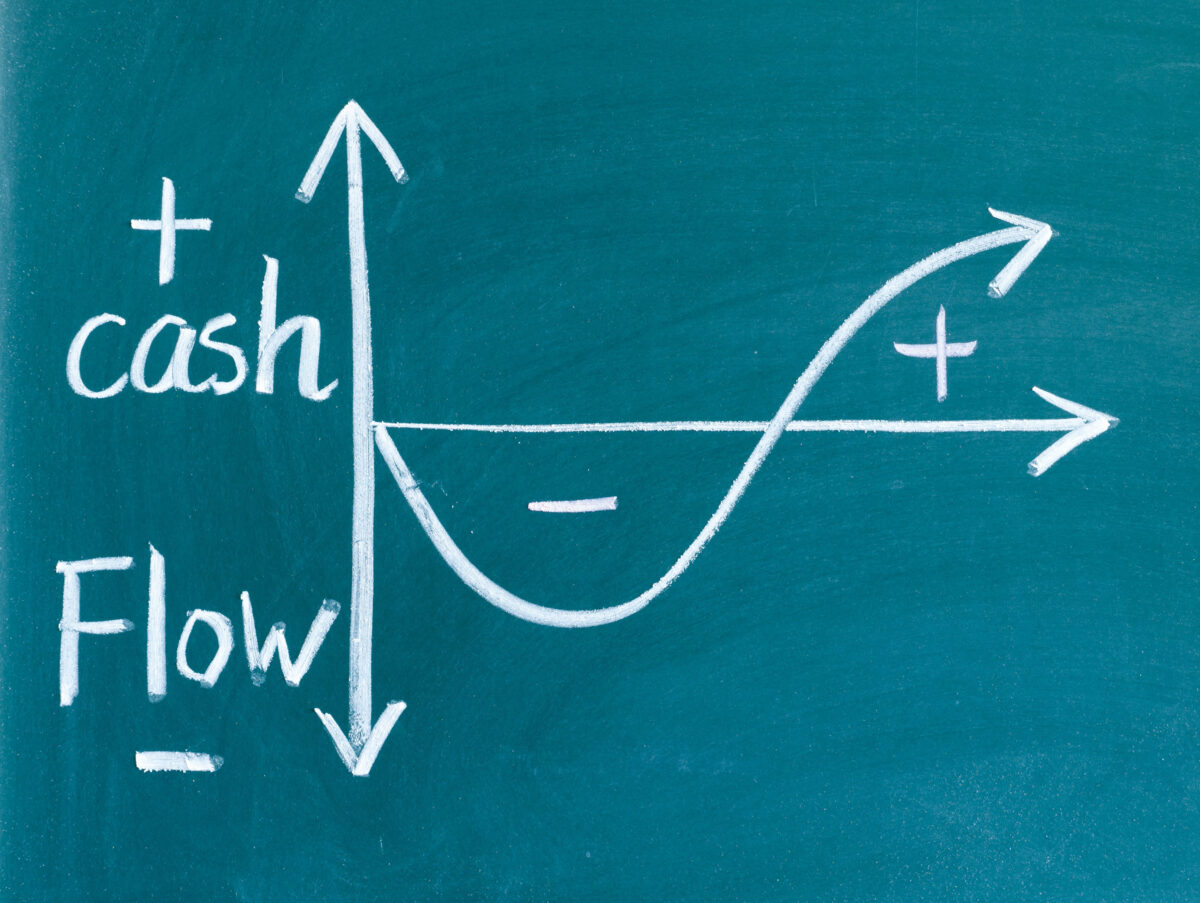

Construction business owners know that cash is king. However, managing cash flow in an industry known for its ebbs and flows isn’t easy. And when you throw in the steady rise of inflation and ongoing supply chain issues, cash-flow management has become more important than ever. Here are nine tips to consider:

1. Perform regular forecasts. Properly executed cash-flow forecasts reveal important trends based on:

- When and from whom revenue is coming in,

- When and to whom money is going out, and

- How much cash you have on hand.

This information can help you identify potential shortfalls and surpluses so you can prepare for slowdowns and seize opportunities. Forecasts can also allow you and your leadership team to see the financial impact of potential investments, such as new equipment. They can also help you calculate how much working capital will be needed to make payments and stay in the black.

Additionally, it’s possible and quite beneficial to perform cash-flow forecasting at the project level. Doing so may enable you to spot when you’re in danger of going over budget on any given job.

2. Implement a rolling cash-flow model. Some construction businesses use a 12- or 13-week model to forecast receipts less disbursements on a weekly basis. Pinpointing immediate financial needs at the most granular level can help you make timely decisions on a variety of short-term strategies, including managing debt reduction and opening bank lines of credit.

A rolling forecast can be customized and updated without major disruptions to accounting. Plus, it can be leveraged to reconcile the weekly forecast to a weekly EBITDA (earnings before interest, taxes, depreciation and amortization) forecast.

3. Review contractual payment terms and billing provisions. When negotiating contracts, think about cash flow. Ideally, the payment schedule should reflect the upfront costs of mobilization — such as being paid for materials once they’re delivered to the jobsite.

If you’re a general contractor, include “pay when paid” clauses whenever possible. As you likely know, this language stipulates that you’ll pay subcontractors and vendors only after receiving payment from the project owner. Having to pay others before getting paid is obviously a recipe for disaster.

4. Negotiate retainage reductions, if possible. Retainage remains a contentious and often unavoidable part of construction work. Assuming you can’t phase out or eliminate retainage as a project progresses, the next best option is scheduled reductions. For instance, a reduction from 10% to 7% can be scheduled when the job is 50% complete, and another one from 7% to 5% can be scheduled when the job is 70% done.

5. Avoid under- and overbilling. Underbilling refers to only partially invoicing for labor, materials and services in a billing cycle. This often occurs because of slow or outdated billing practices and technology. Naturally, cash flow slows as a result.

Although not as problematic, overbilling — invoicing for more work than you’ve so far completed — can lead to running short on cash later in the project if those excess funds aren’t properly managed. Generally, your best course of action is to bill as close as possible to when you incur costs based on a project’s actual progress.

6. Process change orders quickly. Don’t wait for completion to process change orders. Ensure your contracts establish a clear process for submitting change orders and getting timely approvals so you can bill for those additional costs as they come in.

7. Refine your closeout process. The faster you close out a project, the faster you’ll get paid. Stay organized from the start, so you can easily access project-related documentation, punch lists, inspection certificates and lien waivers at completion. Follow a closeout checklist to make sure no steps, documents or necessary signatures are overlooked.

8. Create and maintain a cash reserve. It’s important to have a financial cushion large enough to endure unexpected downturns. Remember the sudden work stoppages when the pandemic hit? Estimate your construction company’s average monthly expenses and save enough cash to cover those expenditures — without benefit of revenue — for at least three to six months. Consider budgeting contributions to your cash reserve as a fixed expense.

9. Engage actively in tax planning. A big tax bill can be a real drag on cash flow, and it’s often an unexpected one. By keeping up with tax planning throughout the year, you’ll more likely avoid nasty surprises and better manage your finances. We can assist you in doing effective tax planning as well as optimally managing your cash flow.

We can help you tackle business challenges like these – schedule an appointment today.

© Copyright 2022. All rights reserved.

More Resources

About The Author

Kirsch CPA Group is a full service CPA and business advisory firm helping businesses and organizations with accounting,…

Sign Up for Email Updates

Tags

Accounting & Financial News

Update on the First-Year Depreciation Tax Rules for Businesses

The One Big Beautiful Bill Act (OBBBA) included favorable changes to the federal income…

Looking to Boost the Profitability of Your Aftermarket Services? Consider Using Agentic AI

For many manufacturers, aftermarket services increasingly account for a significant share of profits, sometimes exceeding those from…

Enterprise Risk Management Built for Nonprofits

Nonprofit leaders might assume that enterprise risk management (ERM) is something only large, complex organizations need (or…