Manufacturers Should Consider These 7 Midyear Tax-Reduction Moves Now

Jul 17, 2024

July marks the halfway point of the year and is generally an ideal time for manufacturers to assess their tax situation and plan appropriate strategies for reducing their 2024 tax liability. Bearing in mind that every company’s situation is unique, here are seven tax-reduction moves to consider.

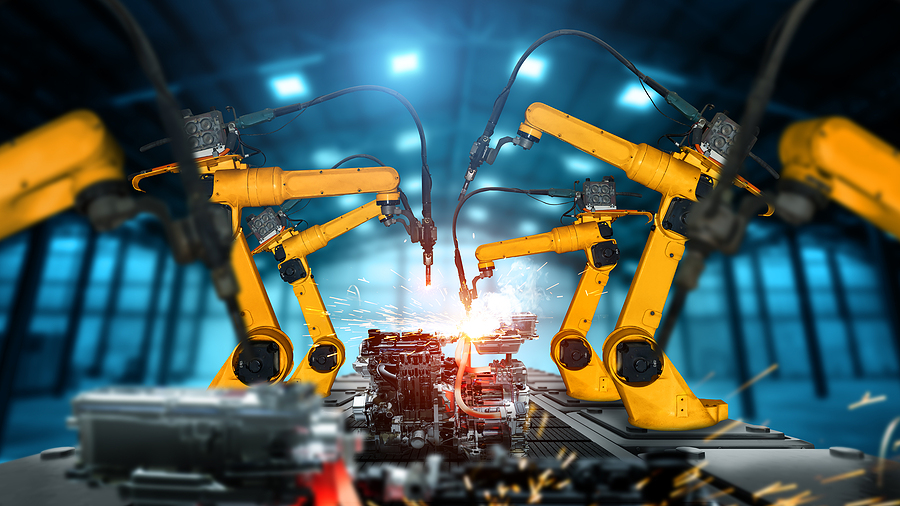

1. Purchase New or Used Equipment

Under the Section 179 expensing deduction, your manufacturing company can deduct the full cost of qualified new or used equipment — such as milling or drilling machines — placed in service during the tax year, up to a limit of $1.22 million for 2024. If the cost of equipment and other eligible assets exceeds an annual threshold, the maximum Sec. 179 expensing deduction is reduced on a dollar-for-dollar basis. For 2024, the threshold is $3.05 million. Also be aware that Sec. 179 expensing can’t exceed net taxable income from business activities.

Fortunately, if you aren’t able to fully deduct your 2024 equipment investments with Sec. 179 expensing, new or used equipment may also qualify for first-year bonus depreciation. For 2024, it’s 60% of the cost of qualified assets. Any remaining costs can still be recovered over time by regular depreciation deductions subject to the usual rules.

2. Conduct Research and Development

Investing in technology today can increase output and streamline operations in the future. One potential tax-saving option is to determine whether your manufacturing company’s research and experimentation expenditures qualify for the research credit (commonly referred to as the “research and development,” or “R&D,” credit).

The research credit generally equals 20% of the qualified expenses above a base amount. Alternatively, you can elect to use a simplified 14% credit. Note that R&D expenses must be amortized over a five-year period.

3. Save Tax Dollars by “Going Green”

The Inflation Reduction Act (IRA) introduced and expanded several clean air tax incentives for expenditures by domestic manufacturers. They include:

- A new production tax credit for energy-saving property with solar and wind energy components.

- The revival of the advanced energy project credit. Generally, this credit is 30% of the cost of constructing, refitting or expanding a manufacturing facility with qualified property.

- The extension of the solar investment tax credit (ITC). The IRA expanded the 30% ITC to include energy conservation technologies; fuel cells, microturbines or energy storage systems and components; and energy-saving property with solar, wind, water, geothermal or other renewable source components.

Manufacturers can also benefit from a credit for electric vehicles (EVs) comparable to the EV credit available to individual taxpayers.

4. Cue the QBI Deduction

Owners of manufacturing companies structured as pass-through entities can benefit from the Section 199A deduction based on their qualified business income (QBI). The deduction is generally equal to 20% of QBI.

But if a taxpayer’s income exceeds the applicable threshold, additional limits begin to apply. For example, the deduction generally can’t exceed the greater of the owner’s share of:

- 50% of the amount of W-2 wages paid to employees during the tax year, or

- 25% of W-2 wages plus 2.5% of the cost (not reduced by depreciation taken) of qualified property owned by the business.

For this purpose, “qualified property” is tangible property (including real estate) owned and used by the company for production of QBI during the tax year.

5. Ramp Up Accessibility Accommodations

A manufacturing company may be entitled to tax benefits for making its facility more accessible to disabled employees. The disabled access credit is available to manufacturers that in the prior tax year had gross receipts of $1 million or less or no more than 30 full-time employees. It’s effectively equal to 50% of the first $10,000 of qualified expenses for a maximum of $5,000. The credit can be claimed, for example, for removing structural barriers or providing accommodations to hearing-impaired individuals.

A manufacturer of any size can deduct up to $15,000 of the costs of removing architectural and transportation barriers to benefit disabled employees. The qualified costs include making accommodations to parking lots, building ramps, and installing water fountains and restrooms that are accessible to people in wheelchairs. Normally, these costs must be capitalized.

Manufacturers can claim both the credit and the deduction in the same tax year (but not for the same expenses).

6. Take Aim at Targeted Jobs Credits

In today’s tight labor market, consider widening your search for job candidates and, in doing so, possibly qualify for a tax credit. For example, a manufacturer can claim the Work Opportunity Tax Credit (WOTC) if it hires a worker from one of several “target” disadvantaged groups. Generally, the WOTC is equal to 40% of the first $6,000 of first-year wages, for a maximum $2,400 per worker. But it can be higher in some cases.

The WOTC has expired and been reinstated multiple times. It was recently extended through 2025.

7. Repair Your Facility

Perhaps your manufacturing company needs to replace broken windows or repair a leaky roof. The tax law allows you to deduct the full cost of repairs. Consider taking care of these minor nuisances before the end-of-the-year crunch.

Conversely, the cost of capital improvements must be depreciated over time. Distinguishing between repairs and improvements can be difficult. Fortunately, some IRS safe harbors can help: 1) the routine maintenance safe harbor, 2) the small business safe harbor or 3) the de minimis safe harbor.

No Time Like the Present

July has arrived. Kirsch CPA Group can help you determine the midyear actions that will be most beneficial to your manufacturing company.

Schedule an appointment to learn how we can support you

© Copyright 2024. All rights reserved.